- Government has allowed the import of 2,200 luxury vehicles.

- This caused dollars starved nation $1.2b in the first half of year.

- PAMA already send a letter to the Ministry of Industries.

KARACHI: At a time when the automobile manufacturers and assemblers are on the verge of closing their plants the Government has allowed the import of 2,200 luxury vehicles, which caused dollars starved nation $1.2 billion in the first half of the current fiscal year.

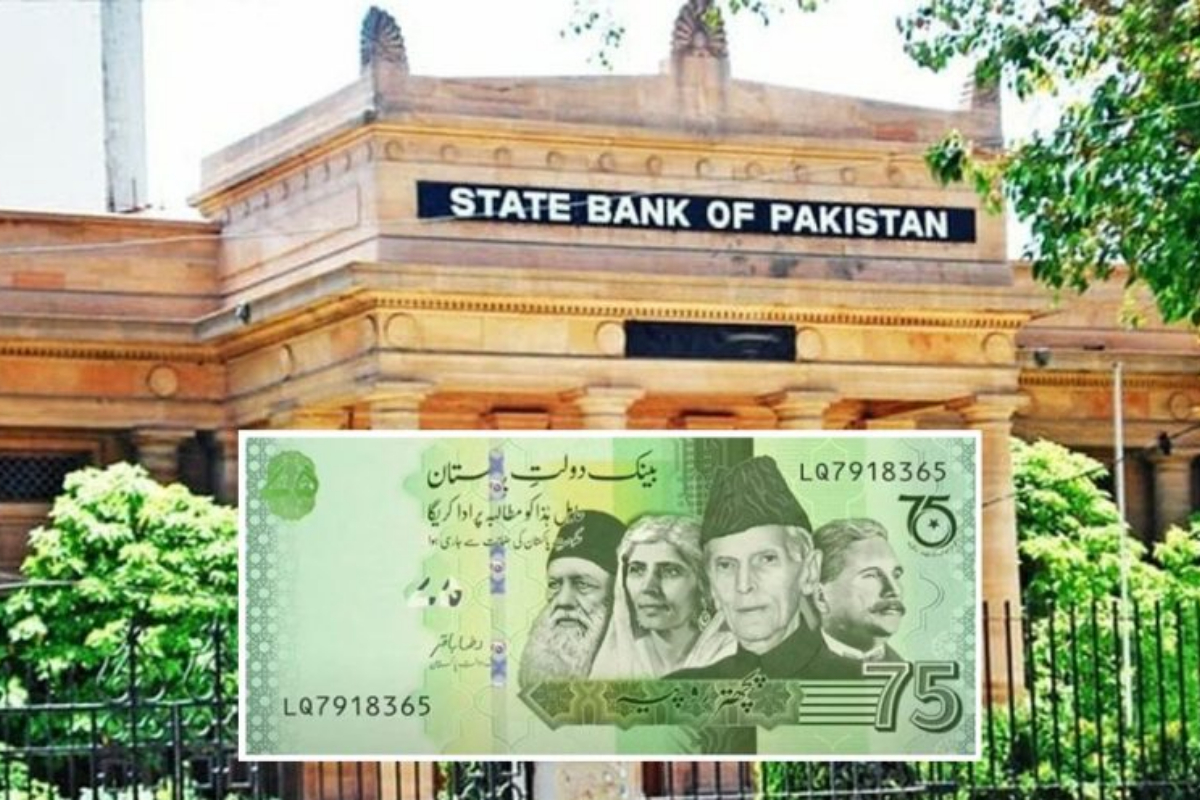

At a time when the country was crippled with strict foreign exchange control even for imports of essential consumer items and industrial goods, $1.2 billion (or Rs259 billion) on the imports of transportation items including luxury cars, high-end electric vehicles, and their parts during the last six months. Pakistan is facing an acute shortage of dollars and has less than $4 billion in its reserves (with State Bank) which is hardly sufficient to finance three-week of its imports.

“We failed to understand what the Government is trying to do, on hand it is allowing import of luxury cars and other expensive vehicles and on the other hand banks showing inability to open LCs citing non availability of dollars, which forcing us to pay huge demurrage charges,” said senior executive of a leading automobile manufacturer. He said that it seems that it is a deliberate act to sabotage the local auto industry which providing jobs to over 4 million people, contributing 4 percent in GDP and paying direct and indirect taxes of over Rs 80 billion in total revenue collection.

The auto company official said that the Pakistan Automobile Manufacturers Association already send a letter to the Ministry of Industries and apprised them the gravity of situation that if issue of LCs would be resolved soon then there will huge lay-offs not only in the auto industry but also in other industries as well and it may lead to economic unrest in the country.

He said Millat Tractors already suspended their operations whereas another leading tractor manufacturer Al-Ghazi tractors operating less than 20 percent of its production capacity. However what was really surprising that few days after the production suspension of Millat Tractors, the Economic Coordination Committee of the Cabinet in a meeting held under the chairmanship of Finance Minister Ishaq Dar allowed import of five years old tractors. “Instead of helping out the local industry which is in hot waters because of the incompetence of the Government, it adding more salt on the wounds industry by allowing the import of tractors which is just scrap nothing else. I fear that they might allow import reconditioned or used cars which would be disastrous for the country. He said demurrage charges of auto assemblers and manufacturers in some cases cost more than the value of consignments.

Pak Suzuki Motor Company Ltd said the ongoing shortage of inventory, which was partly imported from abroad, has led it to extend the shutdown of its automobile plant. However now they resumed their production after SBP assured them all their consignments lying on the port or already been shipped would be cleared. Indus Motors Company (IMC), the maker of Toyota vehicles, had also shut down its production plant in the country from December 20-30, citing a delay in import approvals by the SBP.

As a result of the strict foreign exchange control, the piling of containers containing different consumer and industrial products reaches almost 8,500 in the first half of this year at ports across the country. As per customs data, over 95 per cent of 8,500 containers are held up at ports due to the non-opening of letters of credit (LCs). These containers carry consumer goods, industrial goods, pharmaceuticals and perishable products, while imports of used luxury cars are swiftly clearing at ports.

Data showed that in the first six months, the import of new cars stood at 193 vehicles. Of these only 25 vehicles falls within the category of 1,000-1,800cc while four vehicles above 1,800cc during the period under review.

The bulk of 164 luxury electric vehicles was imported between July and December 2022. The only benefit that Pakistan has from the import of these vehicles is in the shape of duty and taxes which was nearly Rs2 billion. However, the country spent hundreds of billions of rupees on the import of these vehicles.

The real jump was seen in the import of three years old luxury vehicles in the first six months of the current fiscal year. Nearly 1,990 vehicles were imported between July and December 2022.

The import of these vehicles is allowed only for overseas Pakistanis, but this facility is being misused by importers who pay up to Rs10m in the case of SUVs to passport owners.

The bulk of 1,450 used vehicles was imported in the category up to 1,000cc. The import of vehicles between 1,000-1,800cc stood at 370 vehicles while the import of luxury electrical vehicles stood at 20 during the period under review.

The revenue collection on import of used vehicles stood at Rs7bn during the first half of the current fiscal year.

Although overall imports of these transportation vehicles and other items reduced over last year, still the heavy outflows for buying expensive luxury vehicles and unnecessary goods burdened the economy.

During these six months, the country imported completely built units (CBU), completely knocked down/semi knocked down (CKD/SKD) of $530.5 million equivalent to 118.2 billion.

Since CKD kits imports are not allowed, but still multimillion dollars of these kits are being imported, affecting the local industry and their production.

[embedpost slug=”pakistan-heading-in-right-direction-and-will-not-default-ishaq-dar”]

Read more