ISLAMABAD: Federal Finance and Revenue Minister Senator Mohammad Aurangzeb has said that the Pakistan Crypto Council (PCC) marks the beginning of a new digital chapter for the country’s economy.

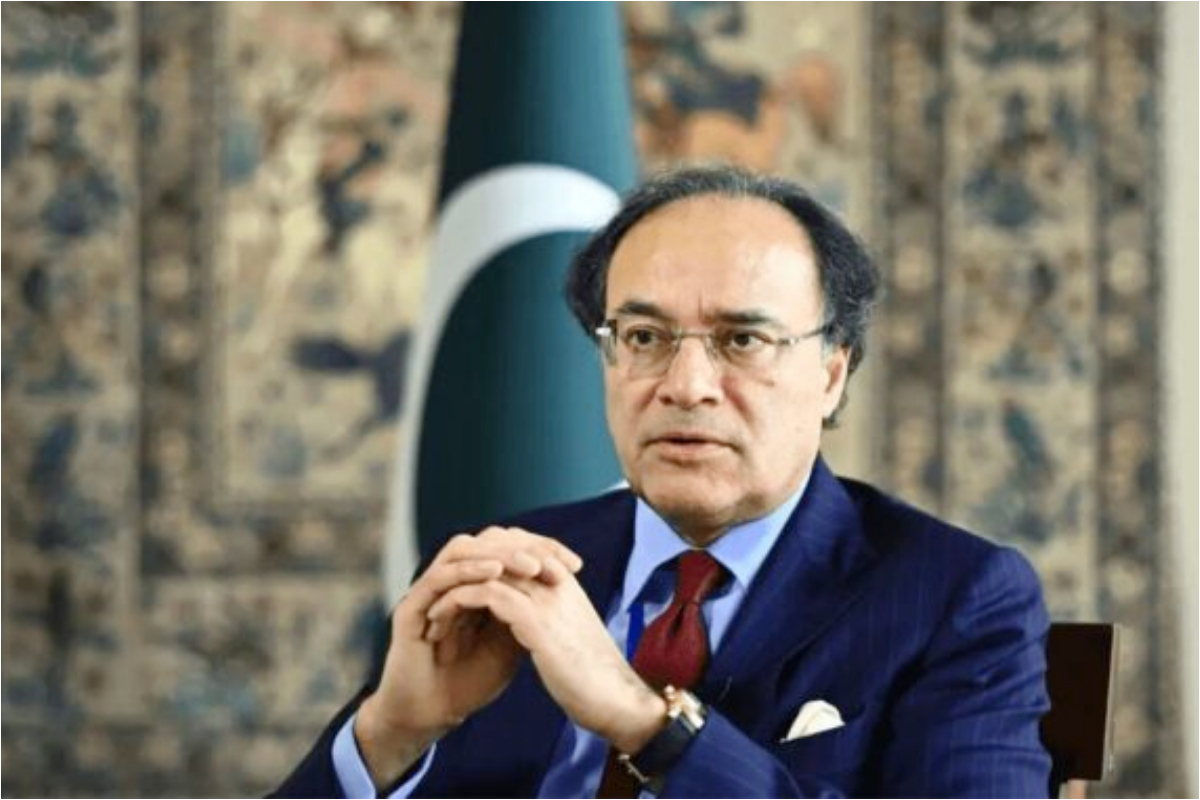

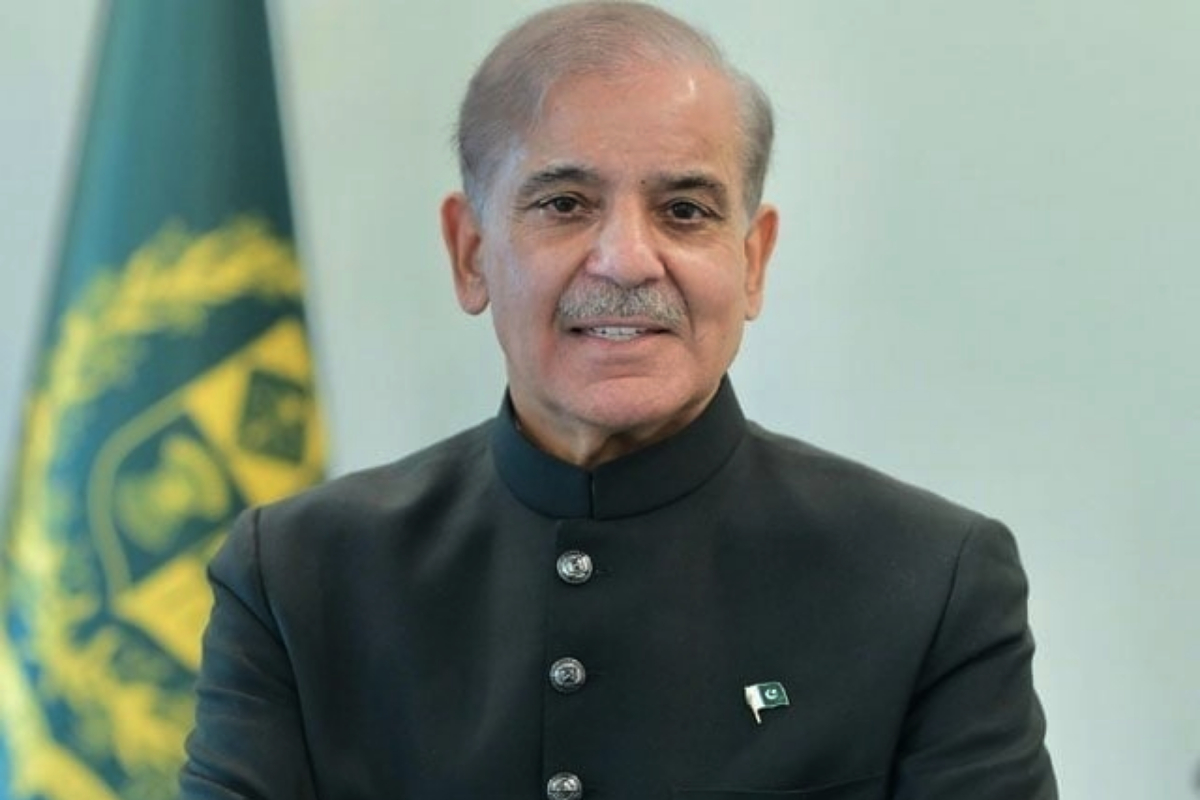

According to a statement issued by the Finance Ministry, Finance Minister Mohammad Aurangzeb chaired the first meeting of the Pakistan Crypto Council.

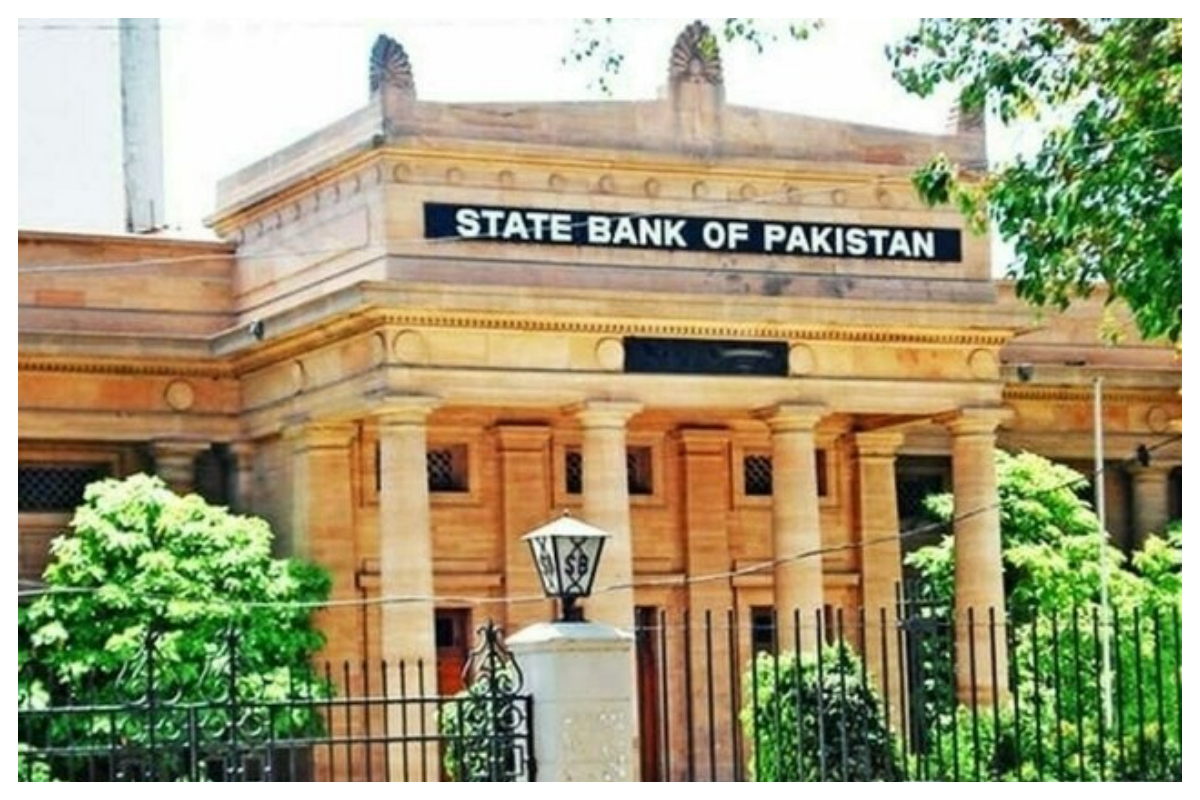

The meeting was attended by Chief Executive Officer (CEO) Pakistan Crypto Council Bilal Bin Saqib, Governor State Bank of Pakistan (SBP) and Chairman Securities and Exchange Commission of Pakistan (SECP).

The meeting focused on exploring opportunities in Pakistan’s cryptocurrency space. Bilal Bin Saqib presented a comprehensive vision and mission for the Crypto Council, which was commended by the finance minister.

Speaking on the occasion, finance minister emphasized that the Crypto Council will serve as a platform to bring together all stakeholders and regulatory bodies. He also reiterated the government’s commitment to creating a transparent and robust financial and economic system.

Muhammad Aurangzeb added that the Council marks the beginning of a new digital chapter for the country’s economy.

[embedpost slug=”pakistan-crypto-council-officially-launched”]