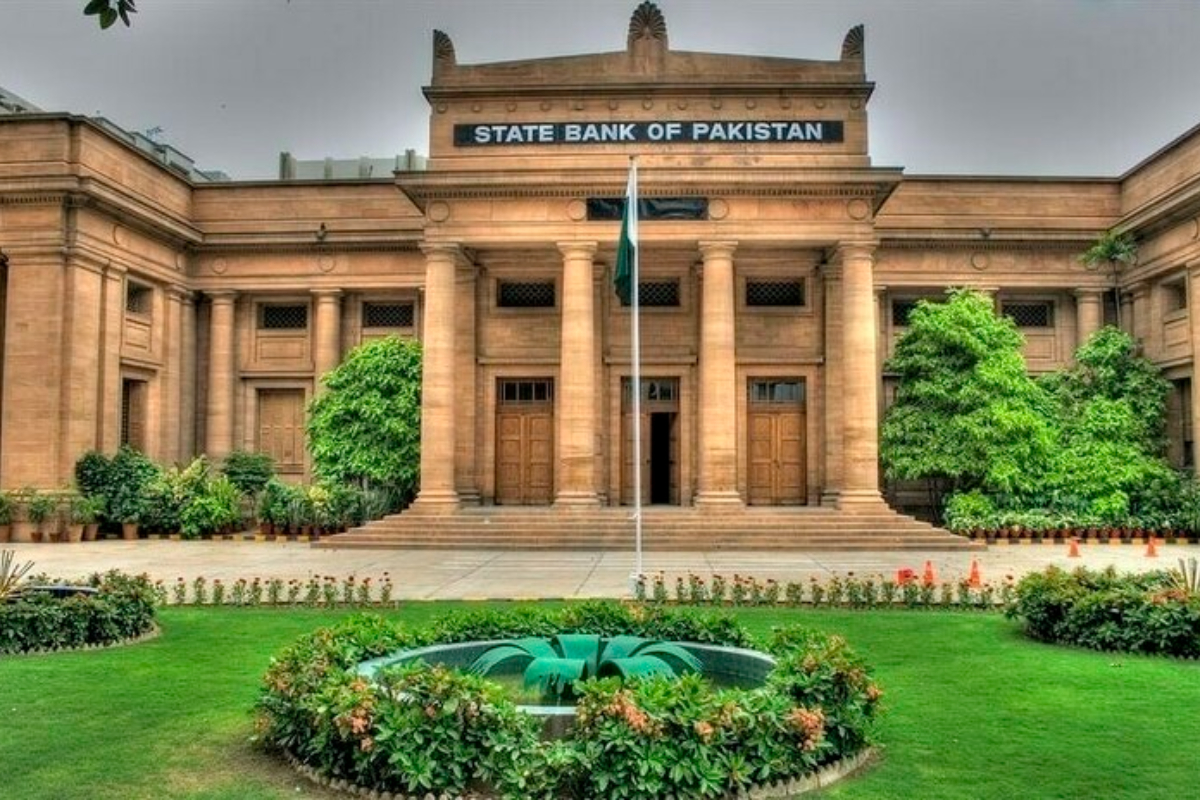

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has decided on Friday to maintain the policy rate at 7%.

SBP via Twitter said that while inflation has risen since January, a small number of energy and food items account for about 3/4 of this rise. Demand-side pressures are contained, wage growth is subdued and inflation expectations are reasonably anchored.

Moreover, encouraged by the revision in FY21 growth to 3.94%, MPC noted this confirms the strength of economic rebound on the back of targeted fiscal measures &aggressive monetary stimulus. However, uncertainty remains due to the 3rd Covid wave, suggesting the need for monetary policy to remain supportive.

SBP also said that looking ahead, in the absence of unforeseen circumstances, MPC expects monetary policy to remain accommodative in the near term & any adjustments in the policy rate to be measured and gradual to achieve mildly positive real interest rates over time.

Earlier the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) in March had decided to maintain the policy rate at 7% for the next two months.

According to a statement from the central bank, growth and employment have recovered since the last meeting in January, and business confidence has improved further.

The statement said that at present the growth rate is around 3% but it is expected to be higher in the financial year 2021 due to better manufacturing prospects and partly due to the monetary and financial stimulus provided during the coronavirus pandemic.

The SBP said recent inflation figures are variable and general inflation in January was the lowest in more than two years but has risen sharply since February, largely due to rising electricity prices and sugar and wheat.

The Monetary Policy Committee said that the recent rise in inflation was mainly due to the supply chain, but that the productivity gap was still negative as estimated and inflation was still largely under control, however, when the recent rise in government prices If the effect of the increase is to dim, then inflation should come down to 5 to 7 percent in the medium term.

[embedpost slug=”pakistans-total-liquid-foreign-reserves-stand-at-us-23-02-billion-sbp/”]