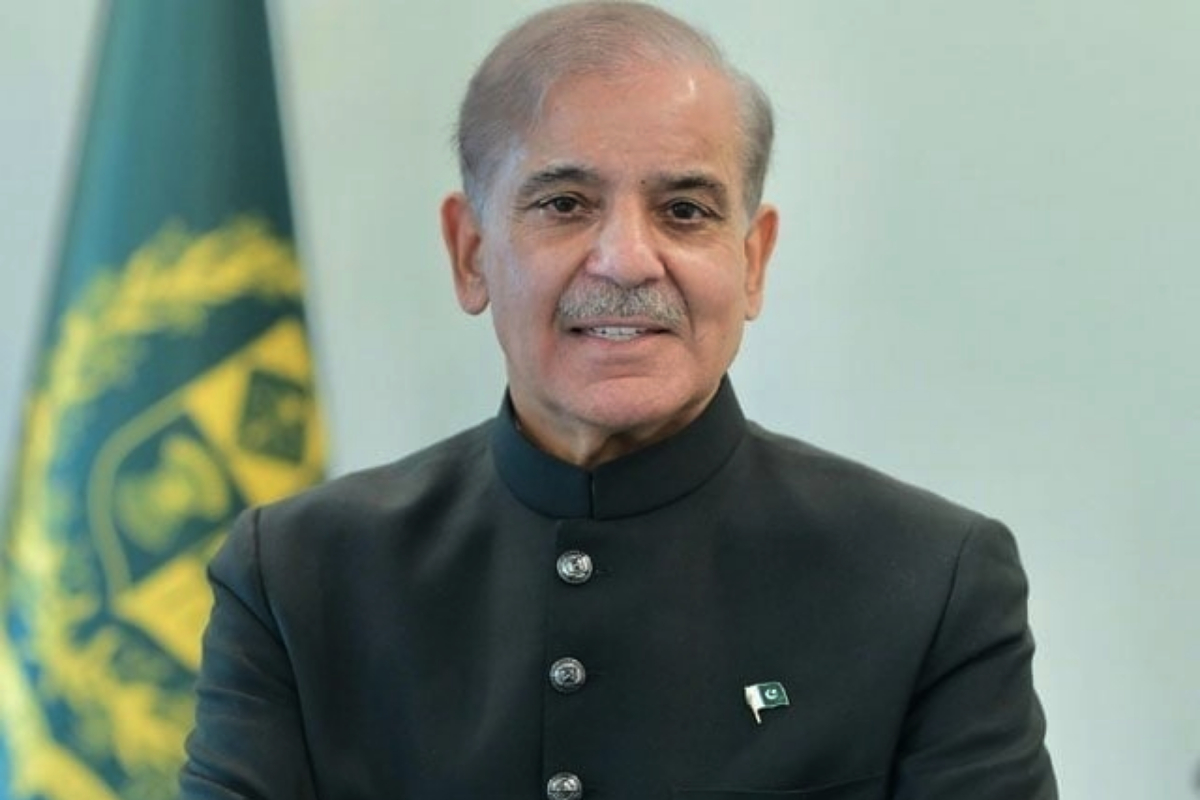

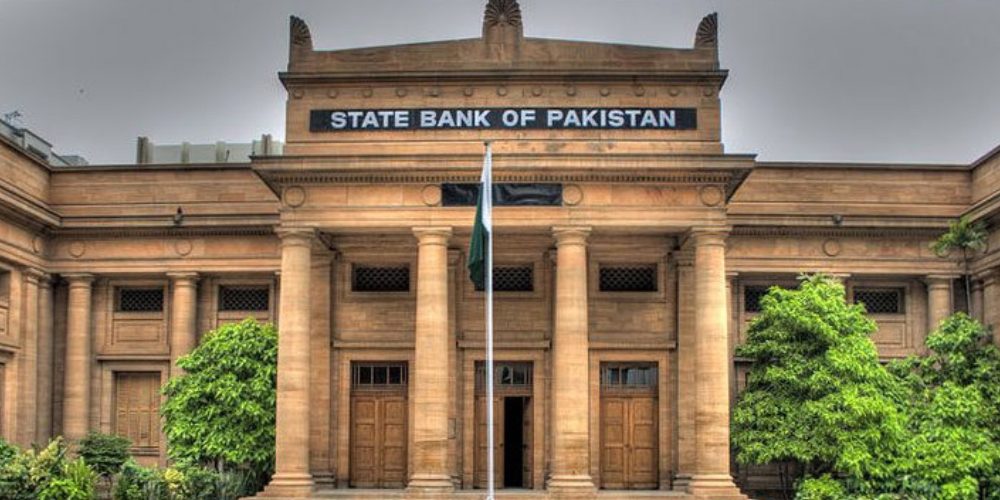

ISLAMABAD: Prime Minister Shehbaz Sharif lauding the policy rate reduction by the State Bank of Pakistan to 15%, said that the government’s economic stability measures were coming to fruition.

The prime minister, in his opening remarks, while chairing the meeting of the federal cabinet, said a further two percent reduction of the policy rate was a pleasing development for business, agriculture, exports, and commerce sectors.

He said SBP had gradually reduced the policy rate from 22% to 15%, encouraging people to invest their money in the economy to create jobs, enhance production, and exports.

Prime Minister Shehbaz said that the policy rate reduction would decrease the debt burden by Rs1.3 trillion providing huge relief and creating a great fiscal space for the country.

He expressed the hope that the country’s economy would strengthen if the indicators continued to move positively.

The prime minister told the cabinet members that in a follow-up of his recent visit to Saudi Arabia, a Pakistani delegation had left for the Kingdom to discuss cooperation in mining and minerals, solar energy and skilled IT workforce which was required by both Saudia Arabia and Qatar.

He asked the IT ministry to give a presentation to explain their strategy to produce IT workforce of international standard to make them cope with the requirements of both the countries.

Calling for swift action on B2B MoUs with Saudi Arabia, the prime minister said the Azerbaijan government had also given a green signal for the signing of $2 billion MoUs to strengthen bilateral cooperation.

“These are good signals. How we take advantage of these is up to us,” he remarked.

The prime minister hinted at announcing a power relief package for the winter season and emphasised facilitating the businessmen to boost their morale.

[embedpost slug=”pti-lawmakers-ruckus-leads-to-prorogation-of-na-session”]

Read more