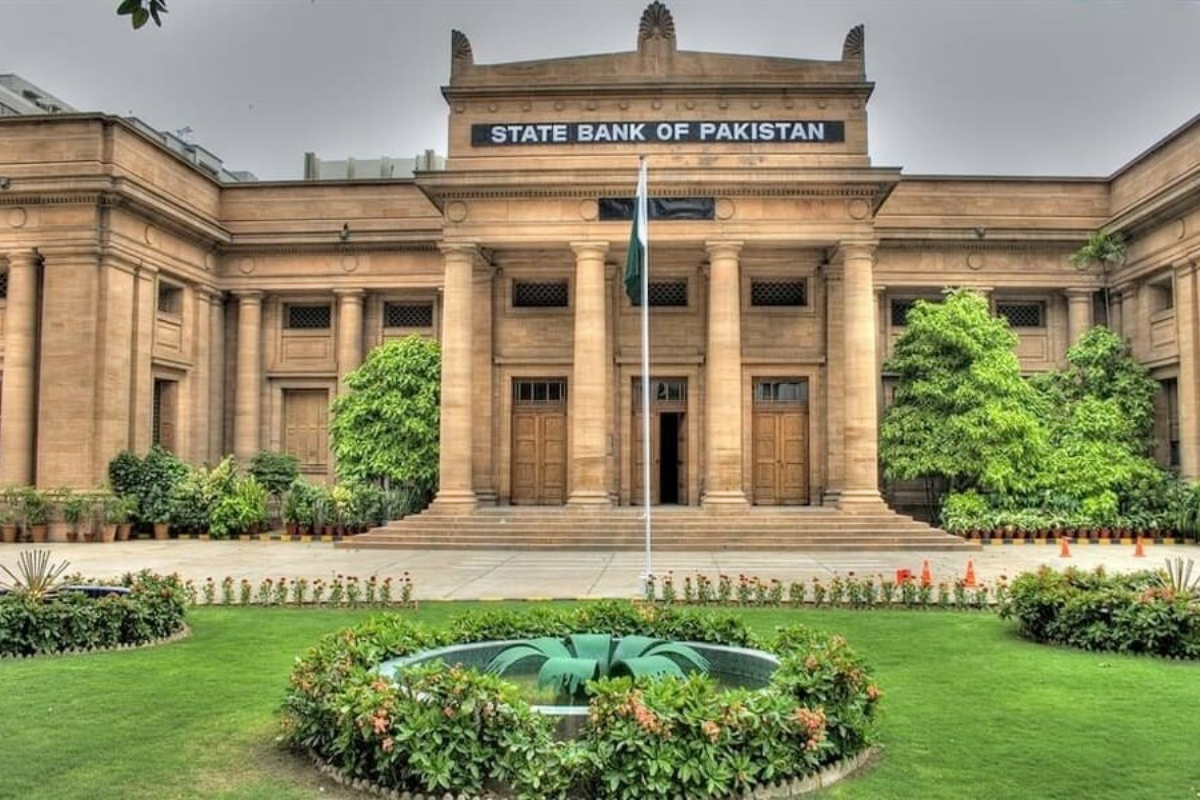

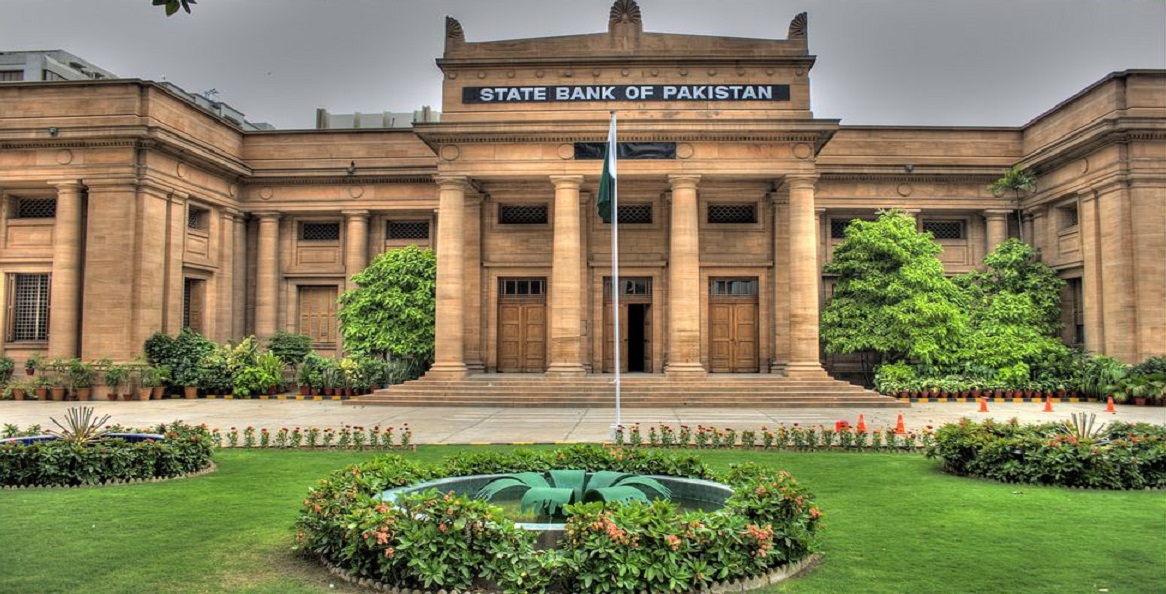

KARACHI: The State of Bank of Pakistan (SBP) has issued Raast participation criteria outlining minimum requirements for the entities desirous of becoming the Raast participants and have the necessary functional and technical capabilities to provide digital payment services to their customers through Raast.

Raast is a state-of-the-art instant payment system launched by the SBP in 2021 to facilitate instant, safe and efficient transfer of funds across the country i.e. “instant payments – Pal Bhar Mein. Mulk Bhar Mein”.

Raast offers bulk payments facility, person-to-person (P2P) transfers, person-to-merchant (P2M) payments, and payment initiation services.

Since its launch, forty-four (44) entities including SBP Regulated and Government entities have been on-boarded on Raast as the participants.

SBP envisages that the issuance of Raast Participation Criteria will facilitate the prospective participants in onboarding on Raast, significantly enhance the number of participants, promote digital payments, and encourage innovation and competition in the payments market.

[embedpost slug=”sbp-cuts-policy-rate-by-100-basis-points-to-12″]