- PPP, PML-N and PTI supported program.

- The standby agreement will play important role.

- All parties supported objectives and policies of program.

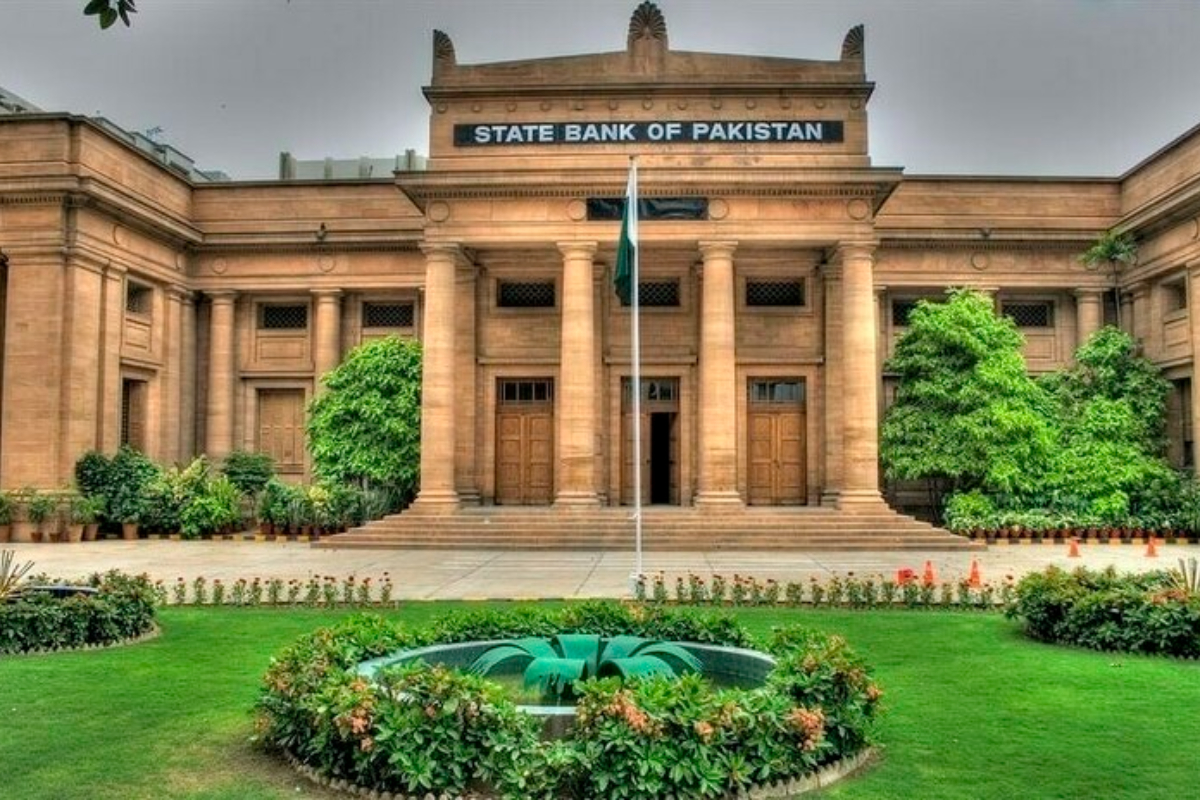

KARACHI: All major political parties of the country gave written assurances to the International Monetary Fund (IMF) to implement the new loan agreement.

Pakistan Muslim League-Nawaz (PML-N), Pakistan Tehreek-e-Insaf (PTI), and Pakistan People’s Party have expressed their determination to remain closed on the IMF loan agreement.

In a statement issued in this regard, the IMF said that Pakistan’s major political parties have supported the program’s objectives and policies.

The Standby Arrangement Agreement will play an important role in restoring macroeconomic stability, the agreement will help in securing external financing in the coming months.

According to the details of the standby program released by the IMF, these parties have supported the objectives and policies of the program. All banks will be obliged to provide details of account holders to FBR, and annual assets of elected or unelected public representatives will be made public. The Central Monitoring Unit will issue performance reports of public institutions.

According to the IMF agreement, the average rate of petroleum levy will be Rs 55 per liter during the fiscal year 2023-24 to generate additional revenue of Rs 79 billion. An additional 30 billion rupees will be obtained from business income and salaried class. 34 billion by collecting a 5 percent federal excise duty on urea fertilizer, 8 billion by raising FED to 20 percent on sugary drinks, and tax revenue of 46 billion rupees will be obtained by increasing tax on the purchase and sale of immovable property from 2 to 3 percent.

[embedpost slug=”dar-vows-to-fulfill-all-intl-obligations-within-stipulated-time”]