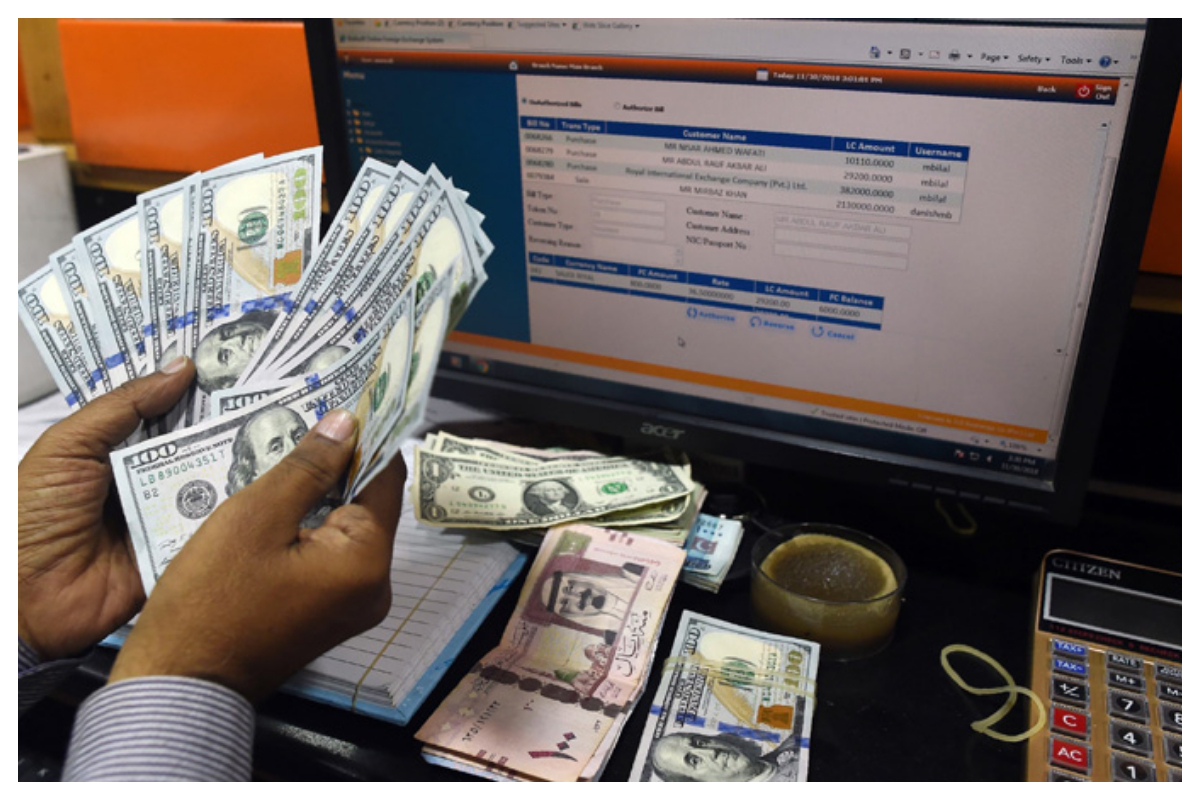

KARACHI: The rupee’s gaining momentum against the dollar ended on Friday as the country faces an economic crisis and record high inflation triggered by the disastrous flood.

The exchange rate witnessed a loss of 38 paisas to Rs218.98 against the dollar from the previous day’s closing of Rs218.60 in the interbank foreign exchange market. The local currency fell to the historic low of Rs239.94 against the dollar on July 28, 2022.

Currency experts said that the local unit shed gains as the Pakistani economy is facing multifaceted challenges in the shape of crop destruction and record high inflation.

Pakistan’s trade deficit widened in August, with analysts expecting a further uptick in the imports of essential items due to destruction of standing crops by the recent floods.

According to the Pakistan Bureau of Statistics (PBS) data, the trade deficit clocked-in at $3.53 billion in August, compared with $2.73 billion, showing an increase of 28.89 per cent.

During the month, the imports recorded an increase of 20.84 per cent to $6.03 billion, compared with $4.99 billion during the previous month.

Similarly, the Consumer Price Index (CPI) inflation in the country increased to 27.26 per cent on a year-on-year basis in August, the highest since November 1973.

Globally, the dollar was headed for its third weekly gain in a row and stood near its highest levels in decades against the euro and yen, with investors in little mood for selling ahead of US labour data that could bolster the case for aggressive interest rate hikes.

The shrinking foreign exchange reserves also remain a key challenge in stabilising the value of the rupee as it witnessed another decline during the outgoing week.

The foreign exchange reserves held by the central bank recorded a decline of $113 million to reach $7.69 billion during the week ended August 26, compared with $7.80 billion on August 19.

The overall liquid foreign currency reserves held by the country, including net reserves held by banks other than the SBP, stood at $13.40 billion. The net reserves held by banks amounted to $5.70 billion.

The country’s current account deficit rose 531 per cent to over $17 billion during the fiscal year 2022 due to massive increase in goods import bill. Overall, the current account deficit was $17.4 billion during the fiscal year 2022, compared with $2.8 billion in the fiscal year 2021, depicting an increase of $14.6 billion.

The local currency remained under pressure since the start of the current fiscal year. The rupee lost Rs14.13 or 6.89 per cent from Rs204.85 to dollar on June 30, 2022 to the current level of Rs218.98.

At the open market, the buying and selling of the dollar was recorded at Rs221 and Rs223 at 5:00pm PST.

[embedpost slug=”rupee-continues-upward-momentum/”]

Read more