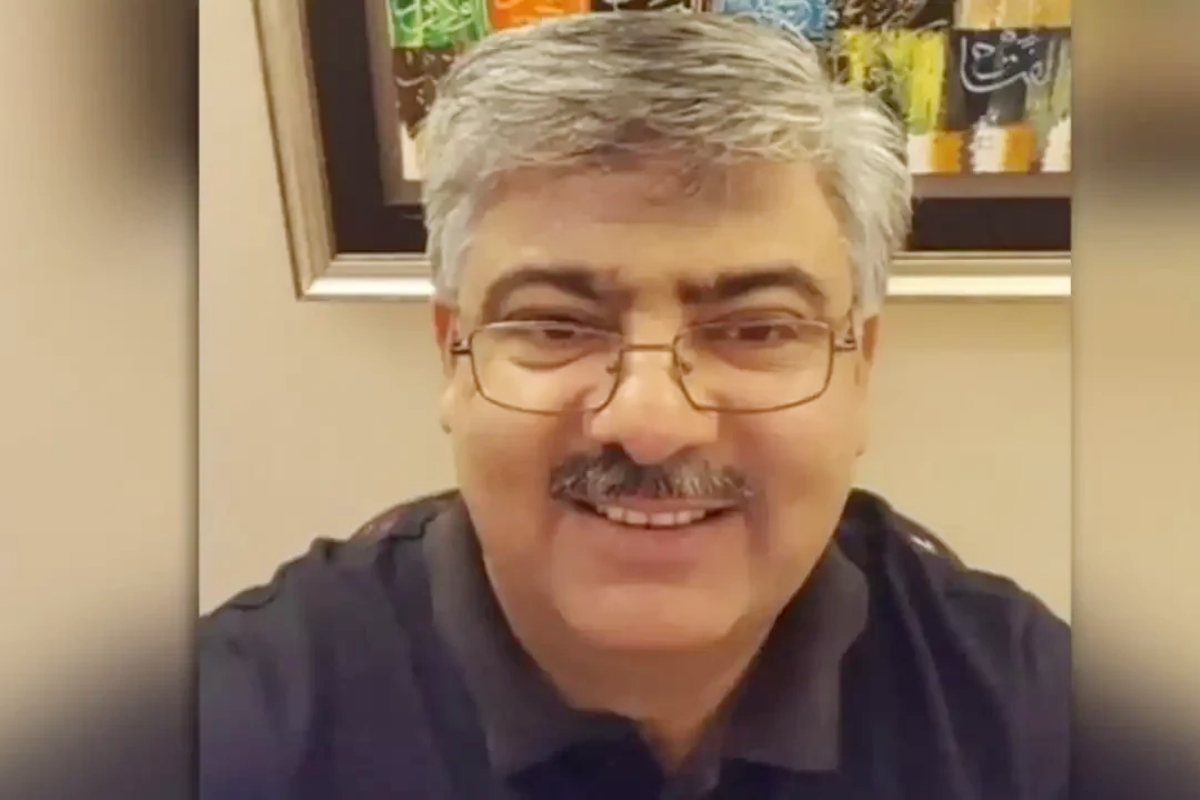

ISLAMABAD: Prime Minister Muhammad Shehbaz Sharif expressed the hope that due to untiring efforts of the economic team, the government would achieve the economic targets in next six months.

Speaking at the cabinet meeting, the prime minister noted that during first five months of current fiscal year, the remittances posted record $15 billion that he hoped would expand to $35 billion by the end of the fiscal year.

He said that the government managed to achieve the macro economic stability despite the fact that the opponents made no stone unturned to sabotage the efforts of the government.

Wishing the participants of the meeting happy new year, the prime minister said that the sun of 2025 will rise with the promise of progress and prosperity for Pakistan.

He prayed that the economic, political and law and order crises that the world faced in 2024 would be overcome by positive progress in the new year.

He said the ambitious homegrown five-year plan titled “Uraan Pakistan” that was launched yesterday would prove to be a milestone for the country’s future provided “we remain on track and work hard to achieve the goals set in the plan”.

He specifically appreciated the efforts of Planning Minister Ahsan Iqbal, Finance Minister Muhammad Aurangzeb and other cabinet members along with the relevant government officials.

He said having achieved economic stability, the country had now entered the growth stage. “If we want to achieve the economic development, then we will have to focus on export-led growth and we have no other option.

The prime minister also appreciate the efforts of Deputy PM Ishaq Dar, Governor State Bank of Pakistan, Finance Minister and Chairman FBR for collecting additional Rs 72 billion under ADR (advance-to-tax ratio) due to which the government’s target of tax revenue for December 2024 had almost been achieved.

Similarly, he said due to funding by the Bill Gates Foundation of $6 million, the digitization work of Federal Board of Revenue (FBR) would become completely digitized.

The early results of this project were that the 39% time duration of container inspection had been reduced while the businessmen got relief of 89%.

Additionally, he said smuggling of sugar through Afghanistan had been reduced to zero which was a positive sign for the country’s economy. He gave the credit of reducing the smuggling to Minister for Industries and Production Rana Tanvir Hussain, the institutions and the Army Chief.

[embedpost slug=”pm-shehbaz-sharif-expresses-hope-for-2025-to-bring-progress-for-pakistan”]