ISLAMABAD: The Federal Board of Revenue (FBR) has decided to abolish the category of non-filers in Pakistan and planning to impose 15 restrictions on non-taxpayers.

The FBR will impose 5 restrictions initially, including property, vehicles, international travel and electricity while there are restrictions on account opening and investment in mutual funds.

FBR announced to introduce several restrictions targeting non-filers to enhance tax compliance and broaden the tax base, the non-filer category will be abolished.

Initial restrictions include buying property, buying vehicles, investing in mutual funds, opening current accounts and international travel (except for religious travel).

The government is doing away with the non-filer category which means that individuals who previously paid a small fee to avoid paying tax on these transactions will no longer be able to do so.

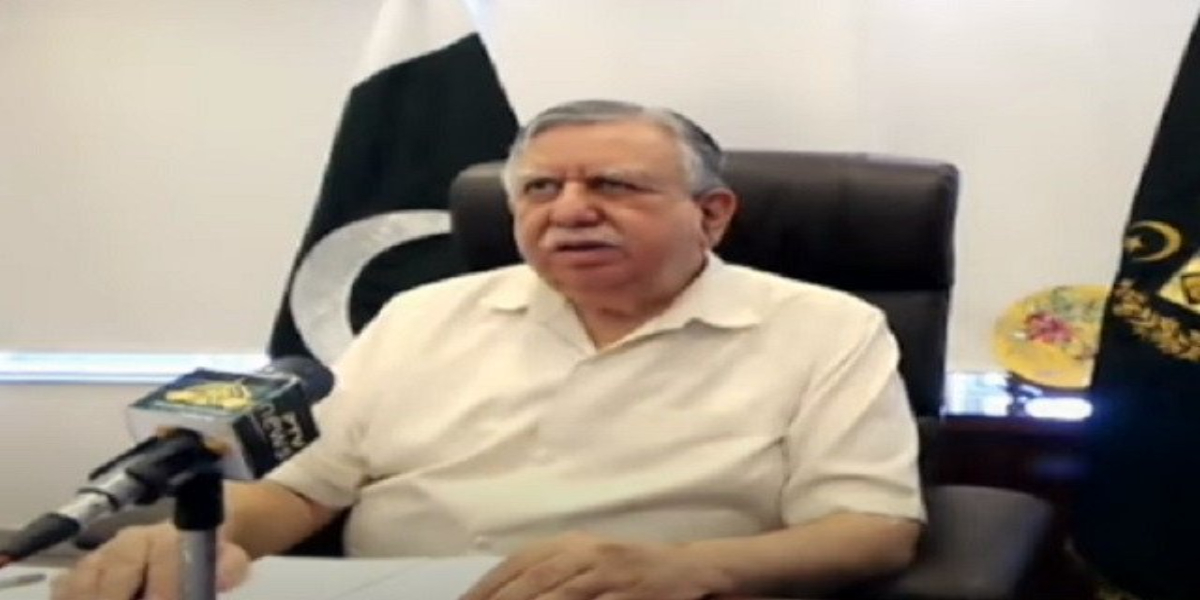

FBR Chairman Rashid Mahmood Langrial revealed that 15 specific activities will be banned for tax return defaulters, focusing initially on 5 key areas. RK is part of the transformation plan, which has been approved by the Prime Minister.

The move will be implemented through an ordinance, and the FBR is already working on its rules and involving the law ministry in the process.

[embedpost slug=”fbr-to-crack-down-on-unregistered-businesses-after-october-1″]