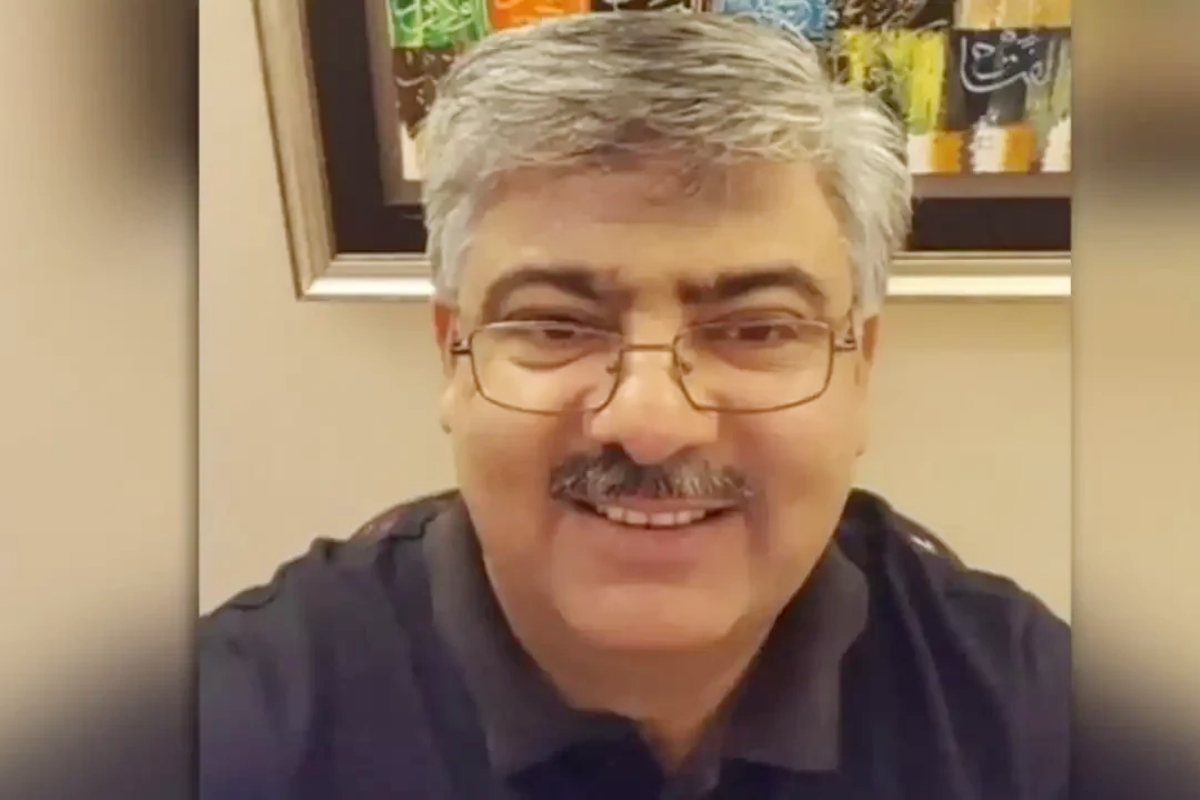

ISLAMABAD: Chairman Federal Board of Revenue (FBR) Rashid Mahmood Langrial has categorically announced that action will be taken against those who do not submit tax returns.

Finance Minister Muhammad Aurangzeb, Minister of State Ali Pervez Malik and Chairman FBR Rashid Mahmood Langrial held a press conference in Islamabad.

While addressing a press conference in Islamabad, Chairman FBR Rashid Mahmood Langrial said that we have given notices to 190,000 people and 38,000 people have submitted 37.7 million tax returns.

He said action will be taken against those who did not submit the return and did not pay the tax.

Chairman FBR said that Pakistan’s tax gap is Rs. 7100 billion and income tax gap is Rs. 2400 billion. He said FBR is digitizing the invoicing process and the focus is on the top 5 percent people.

He said FBR is directly looking at the sugar mills and several mills caught on flying invoices in Punjab.

Speaking at the press conference, Finance Minister Muhammad Aurangzeb said that we have to fix the tax system on a permanent basis and there is a total additional tax potential of RS 71 billion.

He said that technology is very important in tax collection AND transparency has to be brought in the system to prevent tax evasion. He added that human intervention in tax collection of FBR is being reduced.

Minister of State for Finance Ali Pervez Malik said in the press conference that we have to have a partnership with the International Monetary Fund(IMF) and we want standard.

[embedpost slug=”fbr-updates-password-policy-to-enhance-security”]