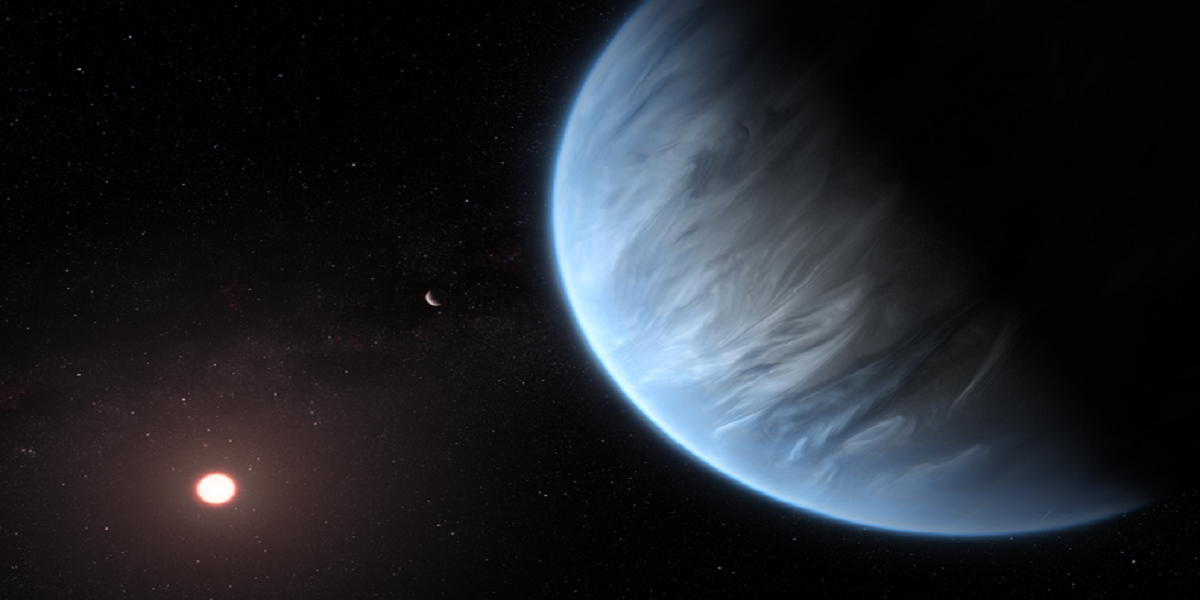

According to international media, astronomers have discovered a planetary system identical to ours about 35 light-years away with a potentially habitable planet.

A star and three planets make up this planetary system. An ocean world, a planet half the mass of Venus, and a potentially livable planet in the habitable zone of the star are among the three planets discovered.

Mara Rosa Zapatero Osorio, an astronomer at the Madrid Center for Astrobiology, has stated: “The planet in the habitable zone may have an atmosphere that could protect and support life.”

Mara is one of the study’s authors, which was published in Astronomy & Astrophysics.

The discoveries near the star, named L 98-59 by the researchers, could be a hint of things to come for modern astronomy, according to the experts.

Earth and Venus are rocky planets that orbit the star close enough to be warm.

Astronomers have been following terrestrial planets since the beginning of astronomy, according to Olivier Demangen, a researcher at the University of Porto’s Space Science Institute. He went on to say that astronomers had finally come close to detecting a terrestrial planet in a star’s habitable zone.

The exoplanet-hunting ESPRESSO instrument on the European Southern Observatory’s (ESO) Very Large Telescope (ESO’s VLT) in Chile has been used to find L 98-59.

Researchers have discovered the following:

Water may exist in the interiors or atmospheres of three previously discovered planets.

L 98-59a, the closest planet to the star, is half the mass of Venus.

Water may exist on the two nearest planets to the star (L 98-59a and L 98-59b).

Water could make up 30% of the mass of L 98-59c, giving it the name “ocean world.”

A fourth planet, L 98-59d, is also present.

There are rumors that another fifth planet, L 98-59d, may have liquid water.

Astronomers plan to investigate the planet’s atmosphere for biosignatures such as oxygen and methane. Biosignatures can point to scientific evidence for the presence of past or present life, but existing telescopes lack the capability to analyze atmospheres.

When the Extremely Large Telescope (ELT) becomes operational in 2027, it is believed that astronomers will be able to find much more.

The most crucial discovery is determining the mass of the planet nearest to the star, which will aid in determining what the planet is made of. The radial velocity approach is being used by astronomers to calculate this.

The planet’s mass and radius are the absolute minimum requirements for the radial velocity approach.

The L 98-59 is expected to be investigated by the James Webb Space Telescope (JWST), which is set to launch in October.

The $9.7 billion telescope weighs 6 tonnes and is made up of 18 gold-plated beryllium hexagonal mirror segments with a primary mirror diameter of 21 feet/6.5 meters.

In comparison to Hubble, the telescope will have far better-infrared resolution and sensitivity, as well as a considerably greater resolution than any ground-based telescope.

[embedpost slug=”mars-needs-people-earth-is-facing-population-collapse-warns-elon-musk”]