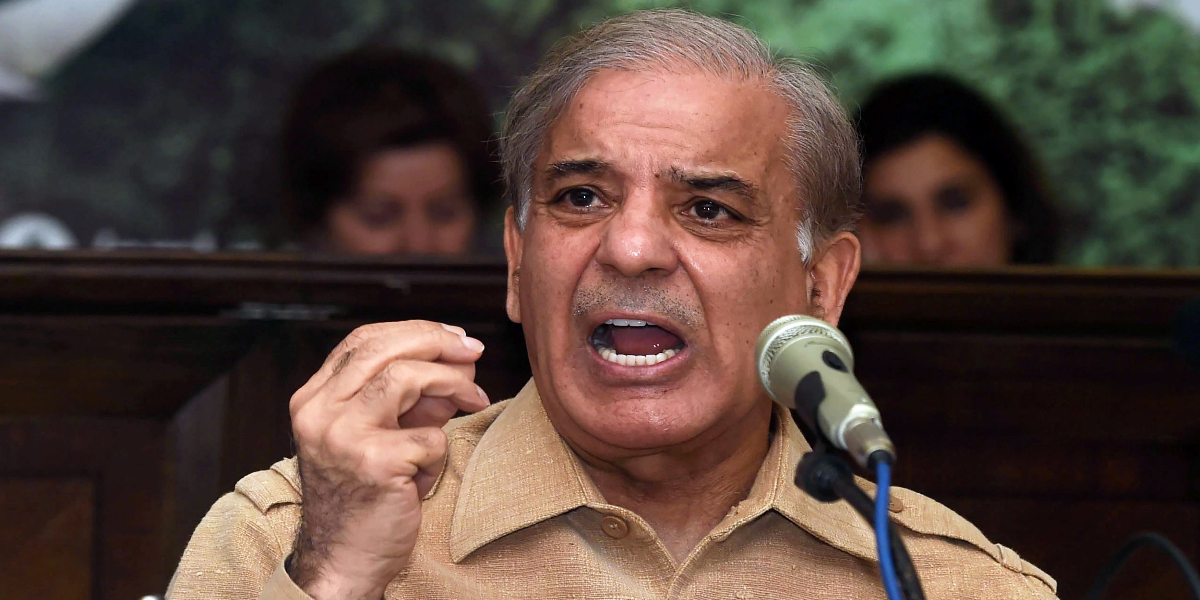

KARACHI: The equity market started the week on a positive note and remained in the green territory throughout the day, as investors’ sentiment was high due to the announcement of major incentives and reduction in taxes in the federal Budget 2021/22, dealers said on Monday.

Ahsan Mehanti at Arif Habib Corp said that the stocks closed higher led by across-the-board scrips, as investors weighed the Federal Budget FY22 relief in the capital gains tax, withholding tax to brokerages and the relaxations of the International Monetary Fund (IMF) on the industrial tariff.

“Record higher global crude oil prices, relief for the pharmaceutical sector and services exporters in the federal budget FY22 played a catalytic role in the bullish close.”

The Pakistan Stock Exchange (PSX) KSE-100 shares index gained 0.87 per cent, or 421.36 points, to close at 48,726.08 points. The KSE-30 shares index gained 0.87 per cent, or 168.7 points, to close at 19,647.43 points.

As many as 413 scrips were active, of which 238 advanced, 161 declined and 14 remained unchanged. The ready market volumes stood at 1.2 billion shares, compared with the turnover of 1.02 billion shares in the last trading session.

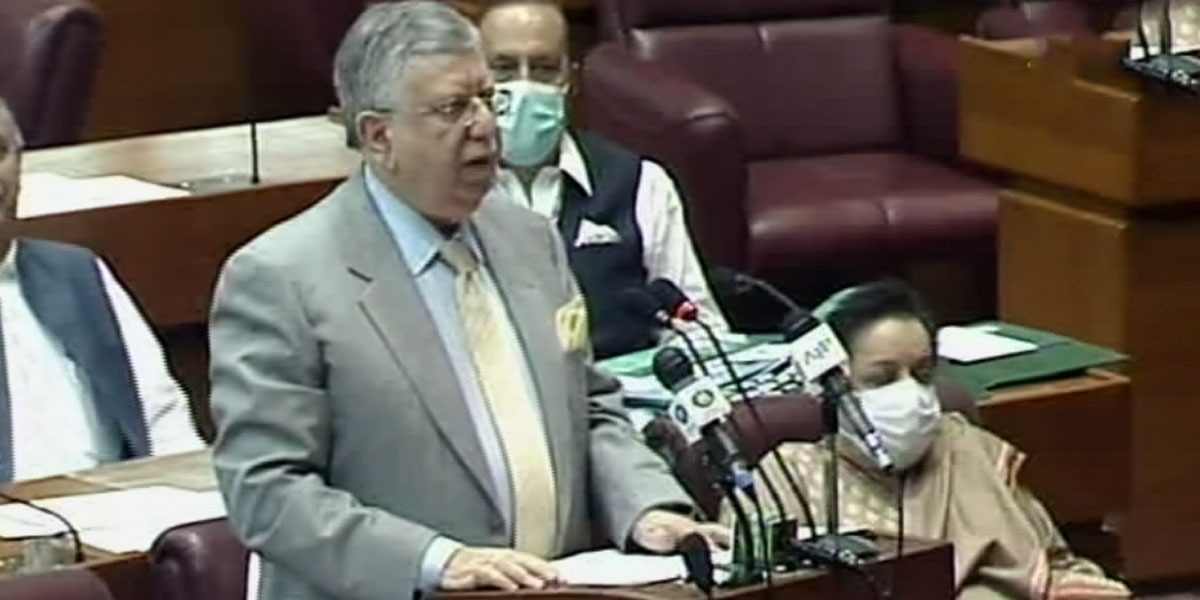

An analyst at Arif Habib Limited said the market opened on a positive note; following the budget announcement on Friday evening.

“Dividend anticipation from SOEs [State-Owned Enterprises] helped the Oil and Gas Development Company Limited (OGDCL) propel to hit the upper circuit; followed by [the] positive price performance of Pakistan Petroleum Limited (PPL).”

Similarly, positive measures for footwear, tyres, refinery, steel and cement sectors supported the listed scrips in these sectors to perform positive during the session. The market hit a high of 677 points after the pre-opening session, after which profit-booking brought the index down by 400 points; however, buying momentum continued, which enabled the index to close up 380 points (unadjusted).

An analyst at JS Global Capital said the PSX witnessed a post-budget rally where the KSE-100 index made an intraday high of 677 points before closing at 48,726 points.

“From the petroleum sector, OGDC, up 7.5 per cent; PPL, up 4.8 per cent; and Mari Petroleum, up 0.3 per cent; gained to close higher on the back of a substantially higher dividend target set by the government from these companies.

From the auto sector, Pak Suzuki (PSMC), up 7.5 per cent gained to close at its upper circuit; following the government’s decision to reduce the general sales tax (GST) on the locally-assembled cars up to 850cc to 12.50 per cent from 17 per cent in the Federal Budget 2021/22, while also providing an exemption from the federal excise duty.

Moreover, the refinery sector gained on significant developments in the Federal Budget for the sector.

“Going forward, we expect the market to persist upside momentum accredited to the notable budgetary measures; therefore, we recommend investors to take exposure in cement, steel, and refineries,” an analyst at Pearl Securities said.

The companies that reflected the highest gains included Rafhan Maize, up Rs190 to close at Rs9,690/share; and Wyeth Pakistan, up Rs150.47 to close at Rs2,156.84/share.

The companies, which reflected the most losses included Sapphire Fiber; down Rs37.97 to close at Rs762.03/share; and Faisal Spinning, down Rs20 to end at Rs410/share.

Highest volumes were witnessed in Byco Petroleum with a turnover of 109.21 million shares. The scrip gained Re1 to close at Rs12.83 share; followed by the Hum Network with a turnover of 108.39 million shares, as it gained six paisas to close at Rs8.68/share. WorldCall Telecom was the third with a turnover of 98.04 million shares, as it gained one paisa to finish at Rs4.23.

[embedpost slug=”image-pakistan-forming-tech-subsidiary-for-tax-incentives/”]