KARACHI: The government on Friday presented the Federal Budget 2021-22 with an outlay of Rs8.487 trillion on the hope of economic revival, development and prosperity.

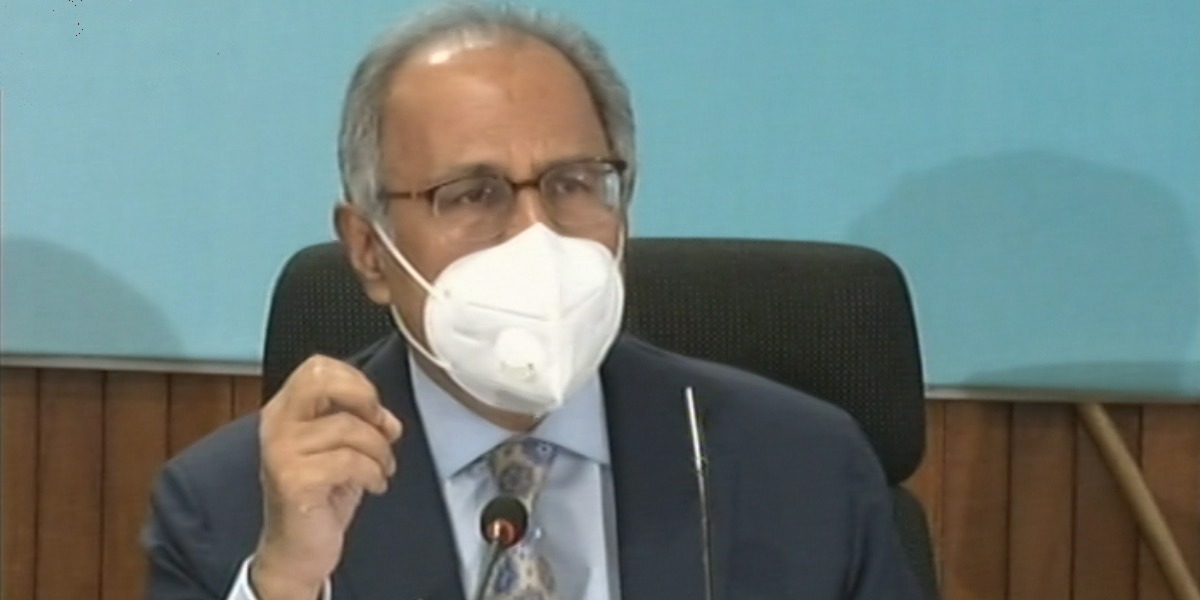

Finance Minister Shaukat Tarin presented the budget in the National Assembly. He said the government had set a GDP growth target at 4.8 per cent.

“We hope [the] growth will be even higher due to the measures we have taken in this budget. Like in the past, we will not leave the weak segments of our society at [the] mercy of the trickledown effect.”

In the next couple of years, the government wants to increase growth to 6 per cent to 7 per cent, Tarin said, adding that the government has estimated tax revenues for FY22 to be around Rs5.829 trillion, and non-tax revenue target is set at around Rs2.080 trillion.

Moreover, the government aims at raising Rs681 billion through bank borrowing, including treasury bills (T-bills), Pakistan Investment Bonds (PIBs) and Sukuk. Proceeds from the privatisation are estimated at Rs252 billion; while net external receipts are estimated at Rs1.24 trillion.

As per the National Finance Commission (NFC) distribution, provinces will get Rs3.412 trillion. The government has set the debt and interest payment target of Rs3.06 trillion for FY22, while civil and military pension spending will be around Rs480 billion.

The budget also estimates subsidies to different sectors at around Rs682 billion, while Rs100 billion have been earmarked to fight Covid-19 woes.

Tarin said that there was no new tax being imposed on the salaried class in the Federal Budget FY2021/22, adding that to support small businesses, the annual turnover tax ceiling has increased from Rs10 million to Rs100 million, while sales tax is being reduced.

The federal excise duty is being removed from cars up to 850cc, while the value-added tax (VAT) on these is being removed. “The government of Pakistan wants to support manufacturing of electric cars for which a lot of tax relaxations are being given,” the finance minister said.

The federal budget has proposed reduction / exemption of Customs duty, additional Customs duty and regulatory duty on the import of goods falling under 589 PCT codes to incentivise the textile industry.

Tarin also proposed reduction / exemption of Customs duty, additional Customs duty and regulatory duty for cables and optical fibre manufacturers; exemption on raw materials for paint industry, chemicals and artificial leather industry, electronics manufacturing industry.

To provide relief to the common man, the government has proposed reduction of additional Customs duty on goods falling under 2,436 tariff lines pertaining to 20 per cent Customs duty slab from 7 per cent to 6 per cent.

Tarin also announced an extension in the exemption from Customs duty on the import of Covid-19-related items for further six months. The rationalisation of regulatory duty on the import of mobile phones to encourage import substitution, and increase in the rates of regulatory duty on the import of non-essential and luxury items to support local industry have also been announced by the finance minister.

To improve ease of doing business, a new uniform export facilitation scheme is being proposed, which will be phased out in the next two years. The sale of goods through online marketplace is proposed to be brought into the sales tax net by deeming the online marketplace as a supplier in respect of the third party sales through their platform.

For specified goods, it is proposed that it may be made mandatory for the manufacturers of such goods to obtain brand licence for each separate brand or SKU. Zero-rating is proposed to be withdrawn from petroleum crude oil, parts / components of zero-rated plant and machinery, import of plant and machinery by petroleum and gas sectors and the supply, repair and maintenance of ships.

The Sixth Schedule and Eighth Schedule of Sales Tax Act are proposed to be streamlined and reduced rates other than relating to basic food items, health and education are proposed to be brought into the standard regime.

The minimum annual threshold of turnover from all supplies for the cottage industry is proposed to be increased from Rs3 million to Rs10 million.

To encourage IT industry in the country, import of plant, machinery and raw material by Special Technology Zone is proposed to be exempted from sales tax. Rising prices of locally-manufactured small cars is a major concern for the low earning families.

Accordingly, it is proposed that small cars up to the engine capacity of 850cc may be exempted from the value-added tax, besides reducing the sales tax rate from 17 per cent to 12.5 per cent.

To reap reasonable revenue from this sector, federal excise on mobile phone calls exceeding three minutes at the rate of Re1/call, SMS message at one paisa/SMS, and internet data usage at Rs5/GB is being proposed. This will result in mild taxation of a broad spectrum of the population.

However, the rate of the federal excise duty on telecommunication is proposed to be reduced from 17 per cent to 16 per cent, he said, adding that the government has also proposed to tax premium on car prices, if the vehicle is sold before registration.

The government has also proposed reduction in the tax rate on capital gains tax on the disposal of shares from the existing 15 per cent to 12.5 percent while reduction in the tax liability by 25 per cent for women entrepreneurs is also proposed.

[embedpost slug=”budget-2021-22-live-updates-latest-news-of-budget-2021-pakistan/”]