The federal government has assigned Rs42, 450 million for the Higher Education Commission (HEC) for the Budget 2021-22 under the Public Sector Development Programme (PSDP).

According to the Budget 2021-22 document, Rs29, 736 million have been reserved for ongoing projects and Rs12, 713 million for new schemes.

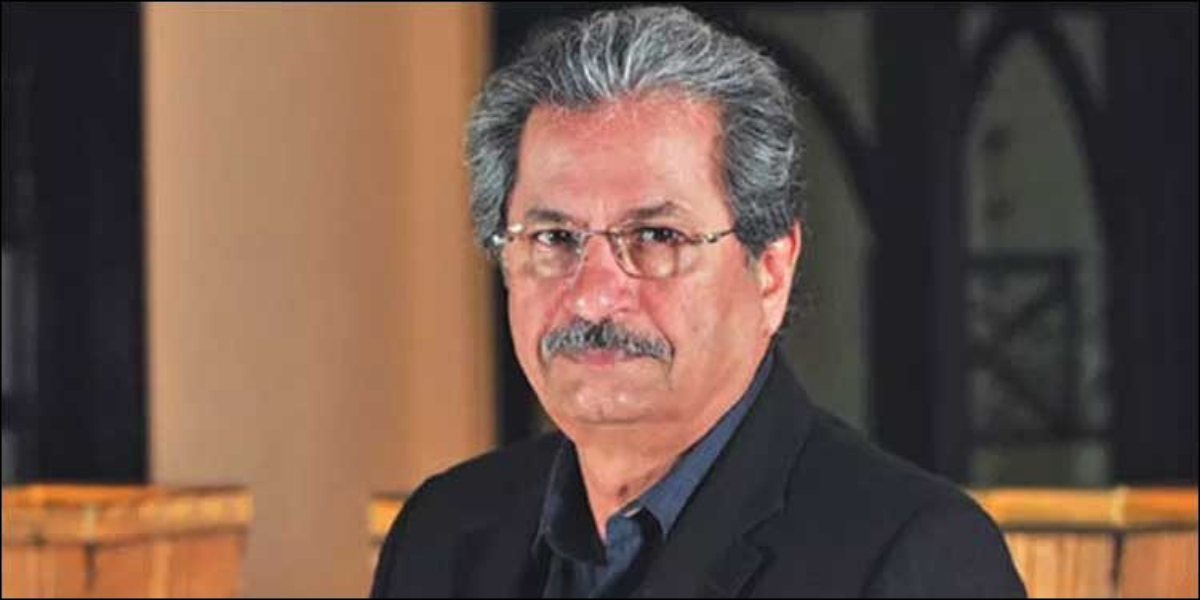

In this regard, Federal Minister for Education Shafqat Mahmood said that the resented budget for education is the “most Pro” Higher education budget ever.

In his tweet on Saturday (today), Shafqat wrote, “Most pro Higher education budget ever. Development spending enhanced to 37 billion. The maximum spent by N in its last year was 18 billion. On the recurring side 66 billion-plus special addition of 15 billion making it over 81 billion. Total allocation to HE 118 Billion. Thx PMIK.”

Most pro Higher education budget ever. Development spending enhanced to 37 billion. The maximum spent by N in its last year was 18 billion. On the recurring side 66 billion plus special addition of 15 billion making it over 81 billion. Total allocation to HE 118 Billion. Thx PMIK

— Shafqat Mahmood (@Shafqat_Mahmood) June 12, 2021

He further extended thankfulness to Prime Minister Imran Khan for the enhanced development in the education sector.

Mahmood further compared the budget announced by the Pakistan Muslim League-Nawaz (PML-N) government in the past years to that of the incumbent PTI-led government.

He said, “Just check the spending figures, not allocation. What’s the use of allocation if not utilised. Total spent on the development side by Pmln govt in its last year was 18 billion. On the recurring side allocation of 81 billion is a 20% jump and the most ever.”

Just check the spending figures not allocation. What’s the use of allocation if not utilised. Total spent on the development side by Pmln govt in its last year was 18 billion. On the recurring side allocation of 81 billion is a 20% jump and the most ever https://t.co/jGinOxldZ6

— Shafqat Mahmood (@Shafqat_Mahmood) June 12, 2021

Budget 2021-22: HEC To Get Rs42.45 Billion

Among the ongoing schemes, an amount of Rs100 million has been allocated for the Centre of Mathematical Science (CMS) at PIEAS Islamabad, Rs225 million for the development of Fatima Jinnah Women University, Campus-II (Phase-2) Chakri Road Rawalpindi, Rs300 million for the formation of Federal Institute in Hyderabad, Rs100 million for setting up the Main Campus of the Federal Urdu University of Arts, Science and Technology in Islamabad and Rs300 million for the establishment of FATA University.

Furthermore, Rs250 million have been allocated for the establishment of NUST Campus at Quetta, Rs500 million for growth and the upgrading of International Islamic University Islamabad, Rs250 million for the establishment of the University of Baltistan at Skardu, and Rs175 million for the establishment of the University Campus for Women at Bannu.

Likewise, Rs1, 750 million have been earmarked for Higher Education Development Programme (HEDP), Rs800 million for Overseas Scholarships for MS/M, and several others.

Among fresh structures, Rs375 million have been earmarked for solidification of Shaheed Benazir Bhutto Women University Peshawar, Rs300 million for consolidation of The Women University Multan (Phase-II), and Rs411 million for upgrading Abdul Wali Khan University Mardan.

Furthermore, Rs1,000 million has been earmarked for the establishment of the Centre for Advanced Research in Molecular, Genetic, and Allied Facilities at SMBB Medical University Larkana and Rs25 million for the unavailable facilities for The Shaikh Ayaz University Shikarpur.