- The S&P 500 finished at 4,130.29, up 1.4 percent for the day.

- The Dow Jones Industrial Average climbed 1.0 percent to 32,845.13.

- The tech-rich Nasdaq Composite Index jumped 1.9 percent.

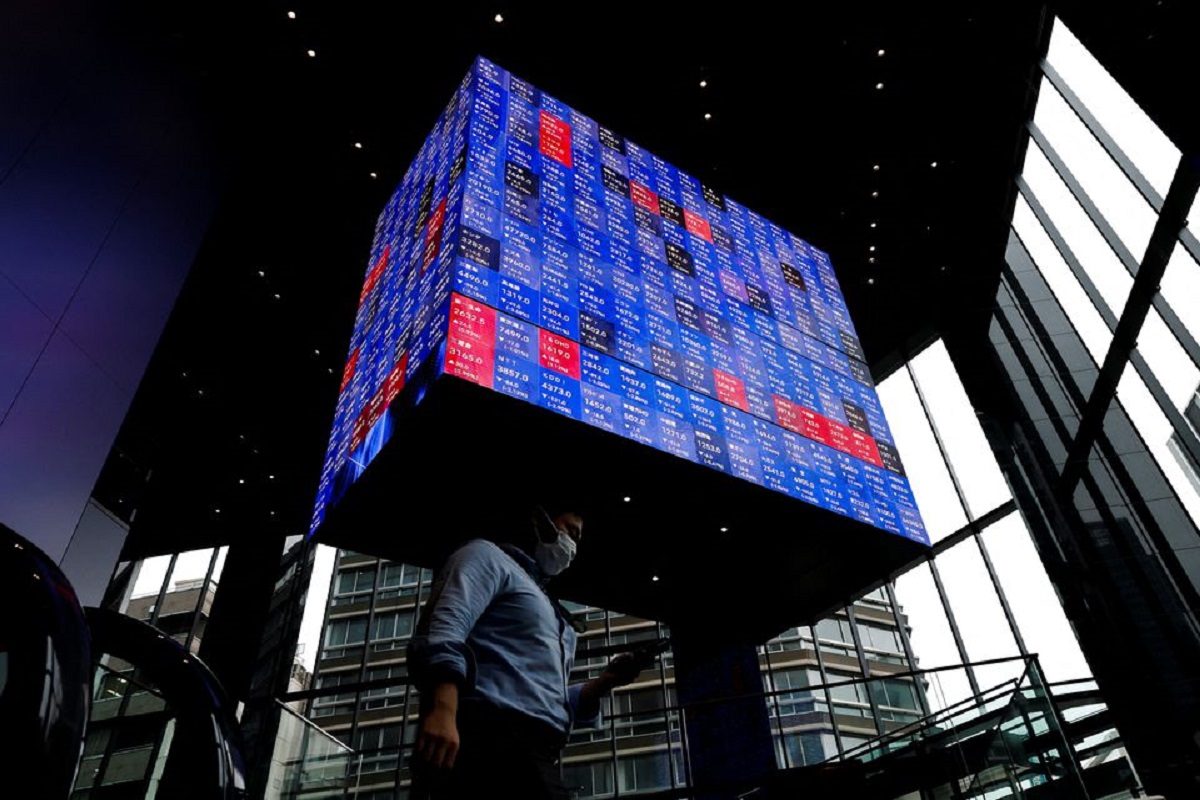

Wall Street stocks finished a strong week on a positive note Friday, extending its rally to three days behind strong gains from Amazon, ExxonMobil and other giants following earnings results.

Investors shrugged off the latest indicator of persistent inflation, as Commerce Department data showed the personal consumption expenditures price index jumped 1.0 percent in June compared to May, outpacing personal income gains, which rose just 0.6 percent.

But stocks continued to push higher, rising again after the Federal Reserve’s second straight 75 basis point increase and negative GDP data suggesting a heightened risk of a US recession.

“The Fed has a clear path to continue with aggressive hikes, but many are still thinking they’ll be inclined to go at only a half point in September,” said Oanda’s Edward Moya.

The broad-based S&P 500 finished at 4,130.29, up 1.4 percent for the day and 4.3 percent for the week.

The Dow Jones Industrial Average climbed 1.0 percent to 32,845.13, while the tech-rich Nasdaq Composite Index jumped 1.9 percent to 12,390.69.

Among individual companies, Amazon surged 10.4 percent after impressing analysts with strong online sales and a good performance in its web services business.

Apple also climbed, winning 3.3 percent after reporting better-than-expected results on continued strength of iPhones.

ExxonMobil jumped 4.7 percent and Chevron soared 8.7 percent after both companies reported quarterly earnings records on the rise in energy prices following the Russian invasion of Ukraine.

But Procter & Gamble dropped 6.1 percent on disappointment over its outlook, while fellow Dow member Intel sank 8.6 percent after reporting a quarterly loss and cutting it sales outlook.

Intel blamed “the sudden and rapid decline in economic activity” as well as “our own execution issues.”

[embedpost slug=”wall-street-stocks-gains-on-goldman-sachs-results-boeing-contract/”]