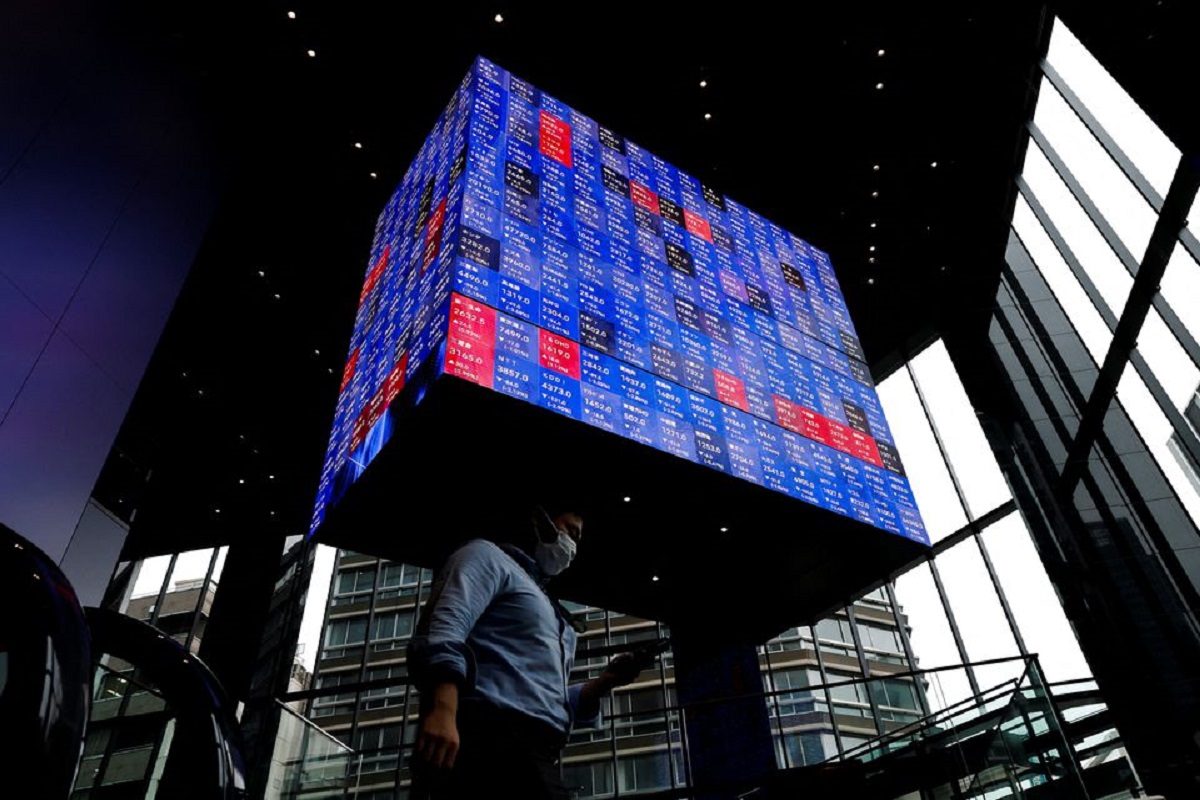

On Wednesday Asia Stock market witnessed a mixed trend, as investors awaited the Federal Reserve’s view on the economy at the end of its policy meeting.

According to the details, after the global equities rallied on Tuesday the data of China’s industrial output and retail sales showed a rise, and later on, US factory productions also increased.

Australian S&P/ASX 200 futures rose 0.75% in early trading.

Japan’s Nikkei 225 futures slid 0.13%.

Hong Kong’s Hang Seng index futures rose 0.33%.

E-mini futures for the S&P 500 slipped 0.01%.

Commodity-linked currencies such as the Australian, New Zealand, and Canadian dollars gained after the positive Chinese data.

But with U.S. lawmakers at a stand-off over a new stimulus package, concerns about the economic recovery remained and the attention of investors shifted to a two-day U.S. Federal Reserve meeting, that started on Tuesday.

Analysts are of the view that “There is some expectation that with the U.S. Congress unwilling and unable to agree to a new fiscal package, monetary policy may need to step in to fill the void,”

“Accordingly markets will be focused on any changes to forwarding guidance and to any balance sheet adjustments.”

Furthermore, the Bank of Japan and the Bank of England announce their respective policy decisions on Thursday.

MSCI’s broadest index of Asia-Pacific shares outside Japan closed 0.65% higher on Tuesday.