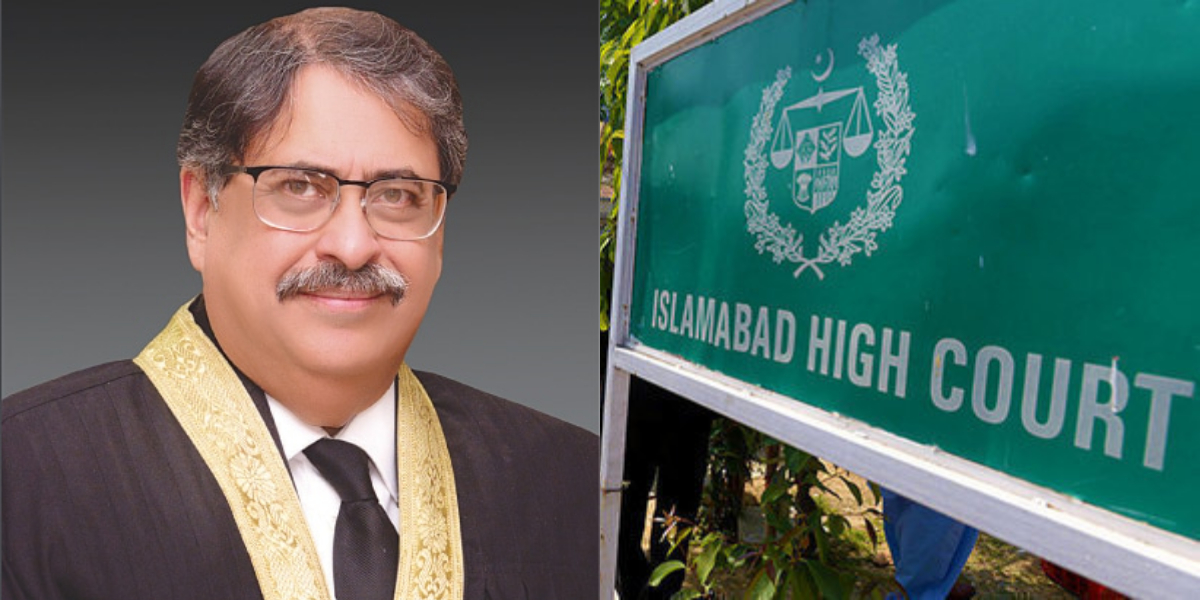

- The new strategy of FBR has come out against tax evaders.

- FBR issued warning to retailers to avoid errors in income tax.

- Regional Tax Offices will conduct audit of real estate taxpayers.

ISLAMABAD: The Federal Board of Revenue (FBR) has decided to audit retailers and real estate taxpayers who have submitted income tax returns.

The new strategy of the Federal Board of Revenue (FBR) has come out against tax evaders, it has been decided to audit retailers and real estate taxpayers who submit income tax returns.

FBR has issued a warning to retailers to avoid errors in income tax and sales tax. The income tax and sales tax returns of retailers will be audited.

FBR sources said that the decision on the audit of income tax and sales tax of retailers will be made in the respective Regional Tax Offices(RTO).

Sources said that a strategy was also made against tax evasion in real estate, audits of taxpayers of real estate will also be conducted and audits of taxpayers’ returns will be done by the respective RTOs.

According to FBR sources, there will be no balloting for tax audit, instead of draw, the concerned RTOs will be able to choose under discretionary powers.

[embedpost slug=”fbr-amends-customs-rules-for-pak-afghan-transit-operation”]