- The drops come as regulators acted to protect consumer deposits.

- Global share prices fell sharply on Tuesday.

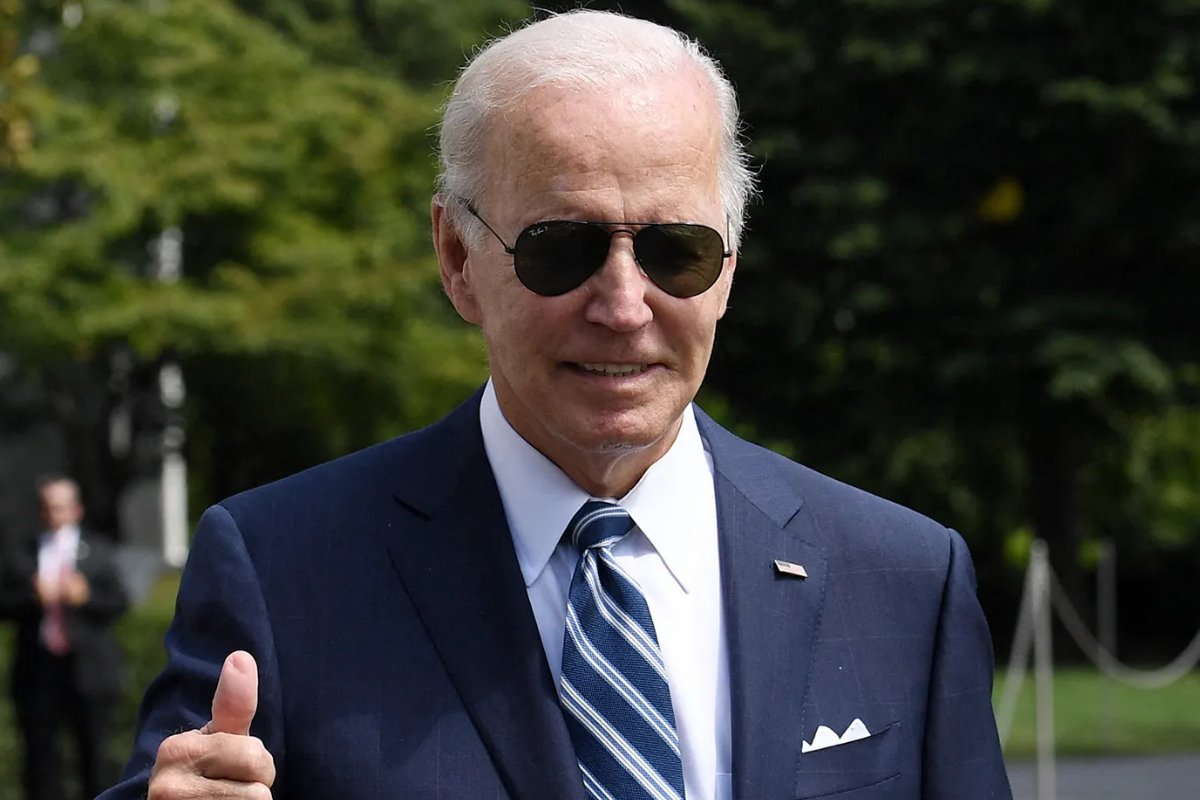

- Joseph Biden pledged to do “whatever is needed” to safeguard the banking system.

Bank shares in Asia and Europe have fallen, despite the US president’s assurances that America’s financial system is secure following the failure of two US lenders.

The drops come as regulators acted to protect consumer deposits after the failures of Silicon Valley Bank (SVB) and Signature Bank in the United States.

Joseph Biden pledged to do “whatever is needed” to safeguard the banking system.

Nevertheless, investors are concerned that the impact would affect other lenders as well.

Global share prices fell sharply on Tuesday, with Japan’s Topix Banks index plunging more than 7%, putting it on track for its worst day in more than three years.

In mid-day Asian trade, shares of Mitsubishi UFJ Financial Group, the country’s largest lender by assets, were down 8.1%.

Bank shares in Asia and Europe have fallen, despite the US president’s assurances that America’s financial system is secure following the failure of two US lenders.

The drops come as regulators acted to protect consumer deposits after the failures of Silicon Valley Bank (SVB) and Signature Bank in the United States.

Joseph Biden pledged to do “everything is necessary” to safeguard the banking system.

Nevertheless, investors are concerned that the impact would affect other lenders as well.

Global share prices fell sharply on Tuesday, with Japan’s Topix Banks index plunging more than 7%, putting it on track for its worst day in more than three years.

As the bank was no longer offering wire transfers, they were taking out their money in cashier cheques.

[embedpost slug=”/joe-biden-responds-to-the-failure-of-the-silicon-valley-bank/”]