- India’s Adani Group has informed creditors that it has secured a $3 billion loan from a sovereign wealth fund.

- Seven listed Adani Group companies have lost more than $140 billion in market value.

- India’s banking and market regulators, as well as the government have launched investigations.

According to two sources familiar with the situation, India’s Adani Group has informed creditors that it has secured a $3 billion loan from a sovereign wealth fund, as the embattled conglomerate seeks to alleviate debt concerns following a short-seller attack.

According to the sources, the sovereign wealth fund’s credit line could be increased to $5 billion, citing a memo distributed to participants as one of the highlights of a three-day investor roadshow that concluded on Wednesday.

The identity of the sovereign wealth fund was not disclosed in the memo. According to a third person familiar with the situation, Adani’s management informed investors that it was from the Middle East.

The sources declined to be identified because they were not authorized to speak with the media. Adani’s spokesperson did not immediately respond to a request for comment from Reuters.

Following the reports, shares in Adani group companies rose 14.7% and 4.9%, respectively, in a broader Mumbai market (.NSEI) that gained 0.9%.

Adani’s new credit comes just a day after group management told bondholders that it expected to prepay or repay share-backed loans worth $690 million to $790 million by the end of March.

These plans were revealed as the group held a fixed-income roadshow in Singapore and Hong Kong this week to reassure investors amid steep share price drops and regulatory probes.

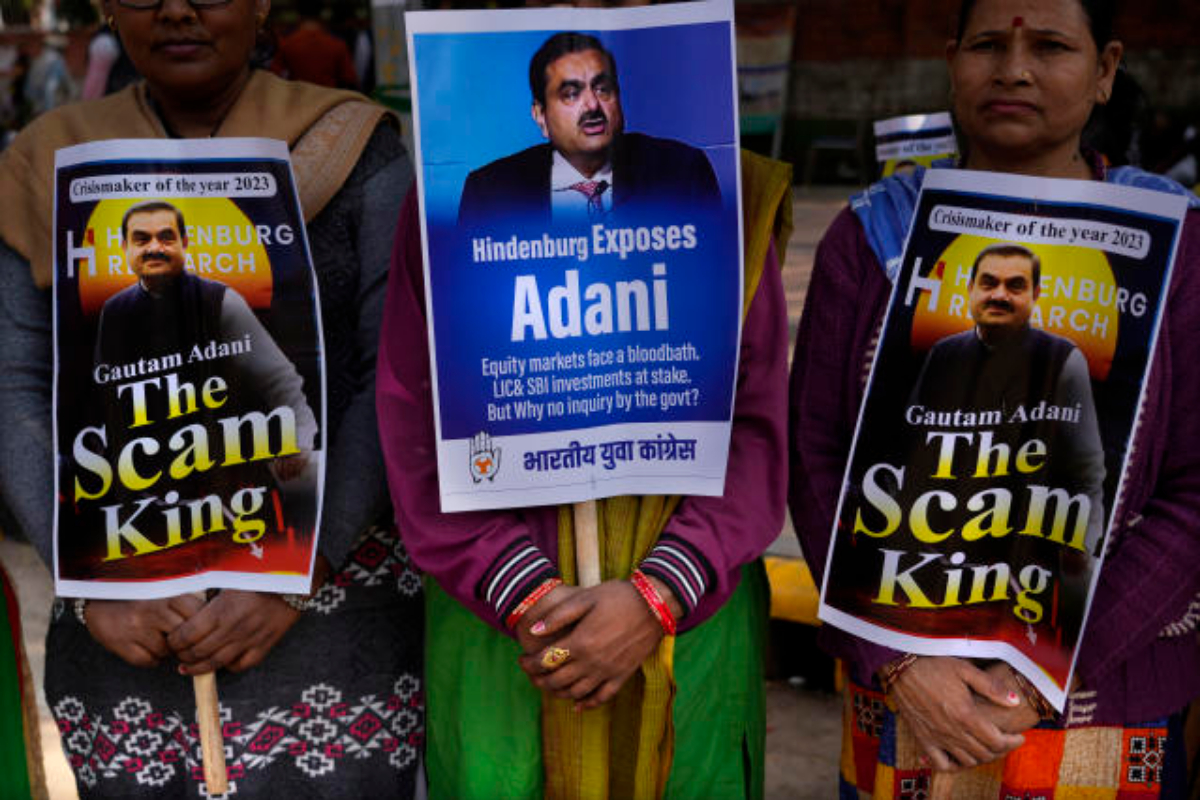

Seven listed Adani Group companies have lost more than $140 billion in market value combined since a Jan. 24 report by sources alleged stock manipulation and improper use of tax havens, and flagged concerns over debt levels.

Adani, led by billionaire Gautam Adani, has denied all allegations of wrongdoing.

The short-seller attack has snowballed into Adani’s most serious business and reputational challenge yet. Adani’s fortunes have risen rapidly in recent years as he expanded his group’s business interests.

To reassure investors, India’s banking and market regulators, as well as the government, have launched investigations.

According to one of the sources, Adani management stated on the final day of the roadshow in Hong Kong that a portion of the $3 billion in credit from the sovereign wealth fund has already been used to repay some of Adani’s share-backed loans.

The management of the ports-to-airport conglomerate also sought to reassure investors that it has enough cash to prepay a large portion of its debts, including onshore bonds, and that it has already begun doing so, according to a source.

However, for offshore bonds, including some three-year US bonds, the group is not allowed to prepay and has no plans to buy them back because it needs to maintain a certain cash level to maintain credit ratings, according to the source.

Adani also held bondholder calls last month in an attempt to assuage investor concerns, during which group executives revealed refinancing plans for some of its units as well as plans to completely pre-pay all loans against shares.

[embedpost slug=”/how-indias-scandal-hit-adani-group-silences-critics/”]