KARACHI: Digital transformation of the global Islamic financial services has become a necessity for its growth, an official said on Wednesday.

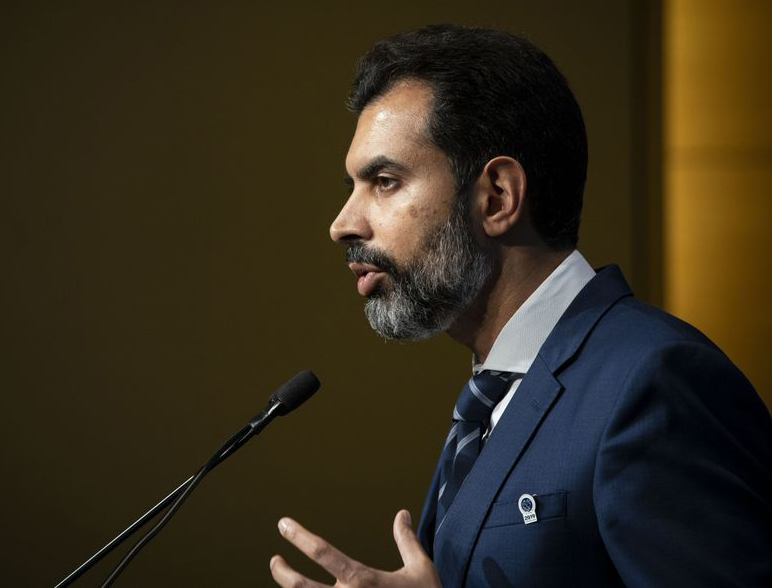

Speaking at the 15th Islamic Finance Services Board (IFSB) Summit 2021, hosted by the Saudi Central Bank in Jeddah, State Bank of Pakistan Governor Dr Reza Baqir said that the focus on innovative ways of service delivery that aligns with the expectations of today’s tech-savvy and convenience-driven customers is the need of the hour.

The theme of the summit was “Islamic Finance and Digital Transformation: Balancing Innovation and Resilience.”

Dr Baqir, who is also the deputy chairman of the IFSB Council, was chairing a session on “Digital Transformation of Islamic Financial Services: Opportunities, Challenges and Policy Implications.”

With fast digitalisation happening in the financial landscape, the Islamic finance industry also needs to move to digitalise their financial services and transform their processes to improve efficiency, reduce intermediation cost and increase outreach to a wider segment of the society, the SBP governor said.

Dr Baqir said that digitalisation of Islamic financial services offers tremendous opportunities in achieving a more inclusive financial system for Islamic countries, where a significantly larger number of adult population is unbanked than the rest of the world.

He advised that the development of Shariah and prudential standards related to fintechs and digital banking, by the international standards setting bodies such as AAOIFI and IFSB, would prove pivotal for the fast-paced development of the global Islamic financial industry and recommended to set up a technical working group to specifically work on these standards.

He touched upon the key initiatives taken by the State Bank of Pakistan during the last few years on the digital front, especially in the wake of the Covid-19 pandemic.

The SBP’s initiatives pertaining to the National Payment Systems Strategy, digital onboarding framework to bring banking services to the fingertips of the customers, digital onboarding of merchants to facilitate the growth of digital payments and the Roshan Digital Accounts for providing innovative banking solutions to millions of non-resident Pakistanis (NRPs), are to name a few, he said.

Other panelists of the session discussed how the digital transformations could benefit and bring significant opportunities for the Islamic finance industry, allowing greater accessibility, convenience, speedy payment transactions and operational efficiency.

The panelists also highlighted new regulatory and supervisory challenges for the financial sector regulators posed by the technological advancements.

Further, they discussed policy implications of digitalisation that focuses on maintaining a balance among financial innovation, integrity and stability.

The 15th IFSB Summit 2021 focused on ways to foster innovation, technological adoption, accessibility and sustainability in the Islamic financial system to aid its future growth and development.

It also highlighted policy implications arising from the rapid digital transformation and the work to be done, going forward, to strengthen its resilience and stability.

The summit convened together high-level participants from regulatory and supervisory authorities, government officials, commercial institutions offering Islamic financial services, international organisations, multilateral development banks, academics and think tanks.

The central bank governors of Saudi Arabia, the UAE, Bahrain, Indonesia, Oman, and Libya were also present at the event.