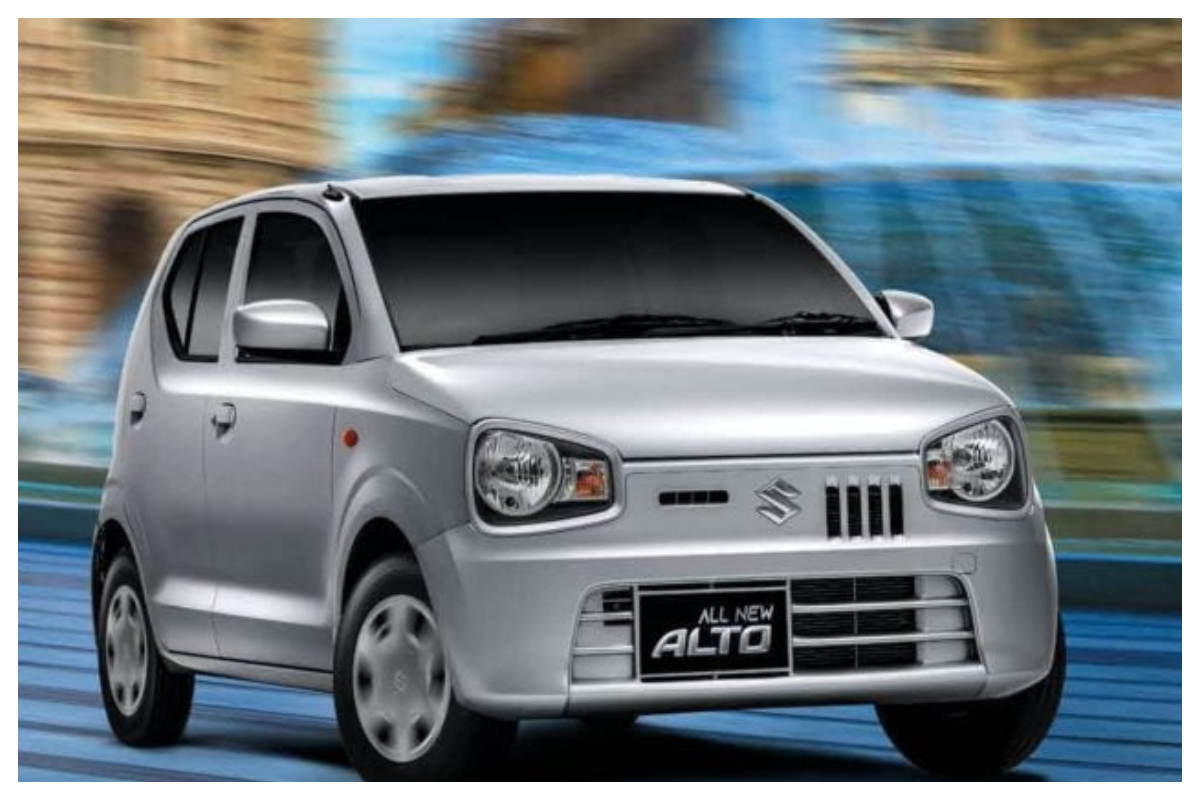

Suzuki Alto Expected Price in Pakistan After Withholding Tax Increase in Budget 2024-25

Suzuki Alto Price in Pakistan after Budget: The federal government has implemented a new car taxation policy in the 2024–25 budget, taxing cars based on engine size to simplify the tax system and boost revenue. The new taxes range from 0.5% to 12% of the vehicle’s value, depending on engine size. The Suzuki Alto, the … Read more