- Kia Sportage has long been a top performer in its market.

- Industry experts predict that sales will continue to drop in the future.

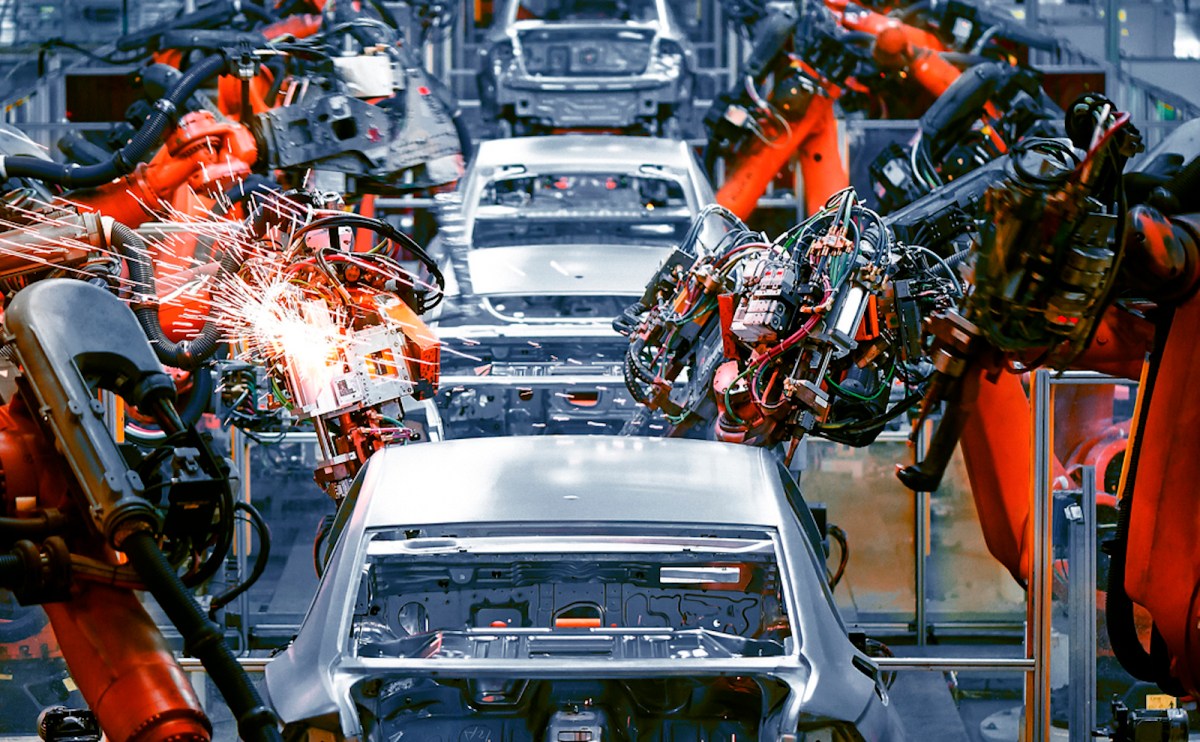

- This is happening as a result of catastrophic inflation and a production halt.

The recent price reductions followed by the most recent price hikes have changed the face of the Pakistani auto sector.

Particularly C-segment crossovers have seen a sharp price increase and have evolved into specialist goods.

The Kia Sportage has long been a top performer in its market, with affordability being one of its defining characteristics. It is now far away from the inexpensive crossover it once was, which also applies to its rivals.

The price increases for Sportage and its rivals since August 2021 (or the time of debut) are as follows:

Note that only Pakistani compact crossover SUVs are included in this comparison.

| Variants | Price in August 2021 (Rs.) | Prices in August 2022 (Rs.) | Increase (Rs.) |

| Kia Sportage | |||

| Alpha | 4,294,000 | 6,250,000 | 1,956,000 |

| FWD | 4,782,000 | 6,750,000 | 1,968,000 |

| AWD | 5,270,000 | 7,250,000 | 1,980,000 |

| Hyundai Tucson | |||

| GLS Sport FWD | 4,979,000 | 6,899,000 | 1,920,000 |

| Ultimate AWD | 5,469,000 | 7,399,000 | 1,930,000 |

| Proton X70 | |||

| Executive AWD | 4,590,000 | 6,740,000 | 2,150,000 |

| Premium FWD | 4,890,000 | 7,190,000 | 2,300,000 |

| DFSK Glory 580 | |||

| 1.5T CVT | 4,229,000 | 5,610,000 | 1,381,000 |

| 1.8 CVT | 4,379,000 | 5,806,000 | 1,427,000 |

| Pro CVT | 4,610,000 | 6,100,000 | 1,490,000 |

| Haval Jolion | |||

| 1.5T FWD | 5,725,000 | 6,020,000 | 295,000 |

| MG HS | |||

| Trophy Edition | 5,749,000 | 8,499,000 | 2,750,000 |

| PHEV | 7,899,000 | 8,900,000 | 1,001,000 |

| Haval H6 | |||

| 1.5T FWD | 6,495,000 | 7,425,000 | 930,000 |

| 2.0T AWD | 7,499,000 (Launch Price) | 8,499,000 | 1,000,000 |

| Toyota Corolla Cross | |||

| Base Grade | 7,689,000 | 12,249,000 | 4,560,000 |

| Mid Grade | 8,199,000 | 13,099,000 | 4,900,000 |

| High Grade | 8,399,000 | 13,419,000 | 5,020,000 |

Widespread Problem

As a result of a delay in the letter of credit (LC) approval for the CKD imports, HACL, Toyota Indus Motor Company (IMC), Pak Suzuki Motor Company (PSMC), and Kia Lucky Motor Corporation (KLMC) announced non-production days earlier this month.

Additionally, the most recent information from the Pakistan Automotive Manufacturers’ Association (PAMA) revealed a sharp fall in sales in July 2022.

PSMC, IMC, and HACL had a sharp decline in sales last month, while Hyundai Nishat Motor Company Limited (HNMPL) failed to sell even one Elantra or Sonata.

Due to catastrophic inflation, price increases, and recurrent production halts, industry experts predict that sales will continue to drop in the future.

[embedpost slug=”comparison-oshan-x7-futuresense-vs-kia-sportage-awd/”]