- 10 percent will be imposed on industries and sectors including cement, fertilizers, steel, sugar, textile, oil and gas, LNG terminals, banking sector, cigarette, chemicals and beverages.

- Up to 4pc tax on high-income individuals will be levied

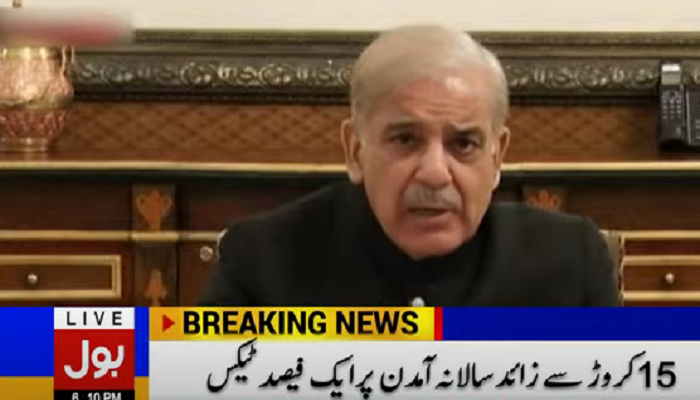

- PM Shehbaz claims the government made brave decisions in time and Pakistan will come out of the crisis because of govt’s steps

The PDM government led by Prime Minister Shehbaz Sharif on Friday announced to impose a 10 percent ‘Super Tax’ on over 12 large industries and also on affluent persons with more than Rs 150 million annual income with a rate up to four percent.

Addressing the members of his economic team, PM Shehbaz said the imposed taxes would be the “first step towards the country’s financial self-reliance”.

We made brave decisions in time and Pakistan will come out of the crisis because of the government’s measures, he asserted and added that the PTI government destroyed the economy as their delayed decisions pushed the country towards bankruptcy. “We wanted to give maximum relief to the people that is why we have made important decisions in this budget.”

Read more: Progressive budgetary measures taken to reduce deficits, ensure sovereignty: Miftah

The prime minister said the 10 percent tax aimed at poverty alleviation would be imposed on industries and sectors including cement, fertilizers, steel, sugar, textile, oil and gas, LNG terminals, banking sector, cigarette, chemicals and beverages.

He said the individuals earning over Rs 150 million a year would pay one percent tax; those earning Rs 200 million will pay two percent, those over Rs 250 million income to pay three percent and the ones earning above Rs 300 million will pay four percent tax.

PM Sharif said he had formed teams to boost tax collection with the help of organs of State institutions and through digital means.

He said the step would help the country attain economic stability and push it out of the shackles of loans.

He pointed out that every year, an amount of around Rs 2,000 billion in the country was misappropriated through tax evasion.

He mentioned that 60 percent of the formal sector was paying taxes, however, the rest of 40 percent economy needed to be brought into tax net.

He said the collected tax would be diverted towards the projects of health, education, skilled training and information technology.

For the first time in the country’s history, he said, a budget had been presented to provide relief to the common man, orphans, widows and poor.

The prime minister hoped that with hard work and faith in Allah Almighty, things would ease up.

The measures taken in the budget will enable the poor to overcome their financial challenges, he added.

PM Sharif said that history was evident that the poor always sacrificed while facing challenges, but now it was the moral obligation of the affluent to come forward and contribute.

Read more: Energy crisis persists in country

He expressed confidence that the measures would take Pakistan forward on the path of prosperity, progress and economic stability.

He mentioned the support of the leaders of allied parties in standing shoulder to shoulder with the government.

He said merit, honesty, integrity and upholding the right of the downtrodden were the hallmark of his government.