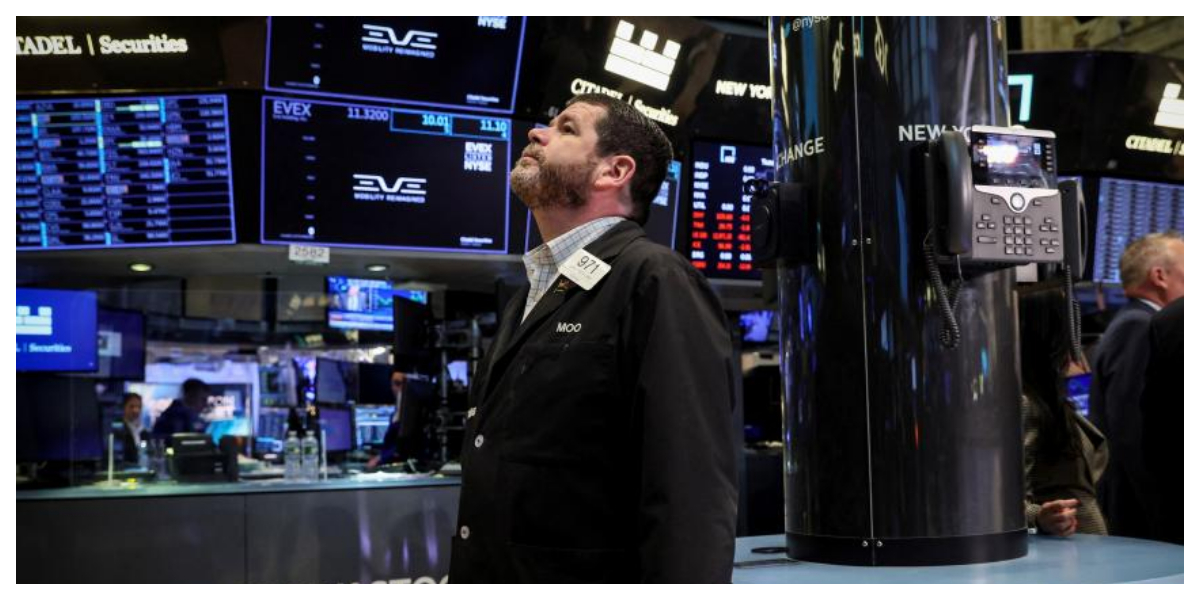

The Dow fell for a fourth instantly consultation Tuesday in advance of a key US inflation file, but crushed-down tech stocks staged a rally amid communication the market has to turn out to be oversold.

A volatile day ended with the 3 foremost indices in a high-quality territory in a partial rebound from Monday’s rout and the typically downcast beginning of 2022, as investors have grappled with inflation, tightening economic policy and the warfare in Ukraine.

“The big question” is whether the market is at the end of the sell-off “or the beginning of a recovery,” said Quincy Krosby, chief equity strategist of LPL Financial.

“Statistically, we probably have more to go on the downside.”

The Dow Jones Industrial Average ended down 0.3 percent at 32,160.74.

The broad-based S&P 500 gained 0.3 percent to 4,001.05, while the tech-rich Nasdaq Composite Index jumped 1.0 percent to 11,737.67.

All eyes will focus on Wednesday’s consumer price report.

US consumer prices jumped 8.5 percent in the 12 months that ended in March, and though economists think that may have been the peak, the rate is likely to remain high for months to come.

The Labor Department is set to release the April CPI data on Wednesday, which economists project will show a much more modest monthly increase, slowing the torrid annual pace.

Pfizer rose 1.8 percent after announcing it would acquire Biohaven Pharmaceutical, a specialist in medications for treating and preventing migraines, for $11.6 billion in cash. Biohaven surged nearly 70 percent.

Duke Realty, which owns industrial properties in US logistics markets, jumped 3.9 percent following an unsolicited takeover offer from Prologis, another company in logistics real estate, of about $24 billion. Prologis fell 5.3 percent.

Peloton Interactive sank 8.7 percent as it reported a quarterly loss of $757 million while struggling with slowing demand compared with earlier in the Covid-19 pandemic.