China introduced a reserve ratio cut on Friday, intended to free up billions of dollars in liquidity as worries intensify over extended Covid regulations that have disrupted businesses across the U.S.

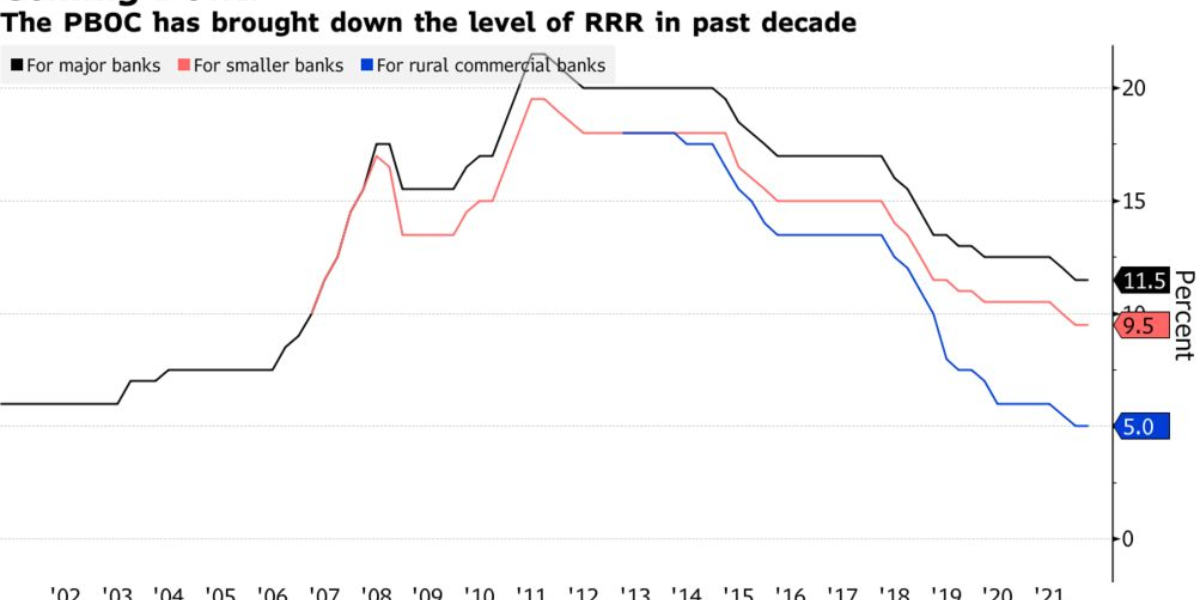

The central bank said it would reduce the reserve requirement ratio (RRR) by means of zero.25 percent points for most banks starting April 25, and zero. Five percent points for a few smaller banks — lowering the quantity of cash banks need to maintain as China battles its worst coronavirus outbreak because the start of the pandemic.

The circulate need to unfastened up some 530 billion yuan ($eighty three billion) of long-term liquidity to be injected into the economic system, the bank stated in a declaration.

A virus surge has caused regulations on dozens of towns in recent weeks as officers stick with a strict zero Covid policy of stamping out clusters as they emerge, leaving areas just like the key enterprise hub of Shanghai locked down for weeks.

Manufacturers had been compelled to halt operations, whilst carmakers warned this week that the state of affairs could threaten auto output and key ports like Shanghai have become clogged.

A key purpose of the charge cut is to “guide financial institutions to actively use budget from the RRR cut to guide industries and small, medium and micro organizations significantly affected by the pandemic,” said the People’s Bank of China in a assertion.

It brought that the pass would additionally reduce the capital costs of economic institutions through approximately 6.5 billion yuan consistent with year.

Analysts stated the circulate might have a restricted effect at the slowing financial system.

“The RRR cut should nudge down bank lending rates, which will take a bit of pressure off of indebted borrowers,” said Julian Evans-Pritchard, senior China economist at Capital Economics.

“But on its own it will do little to boost lending growth.”

The reduce was additionally much less than the marketplace expected, stated Zhiwei Zhang, leader economist at Pinpoint Asset Management.

“I don’t think this RRR cut matters that much for the economy at this stage,” he said.

This is because the main challenge remains Omicron-driven virus outbreaks and hard lockdown policies — a Beijing policy that looks unlikely to change.

“More liquidity may help on the margin, but it doesn’t address the root of the problem,” he said.