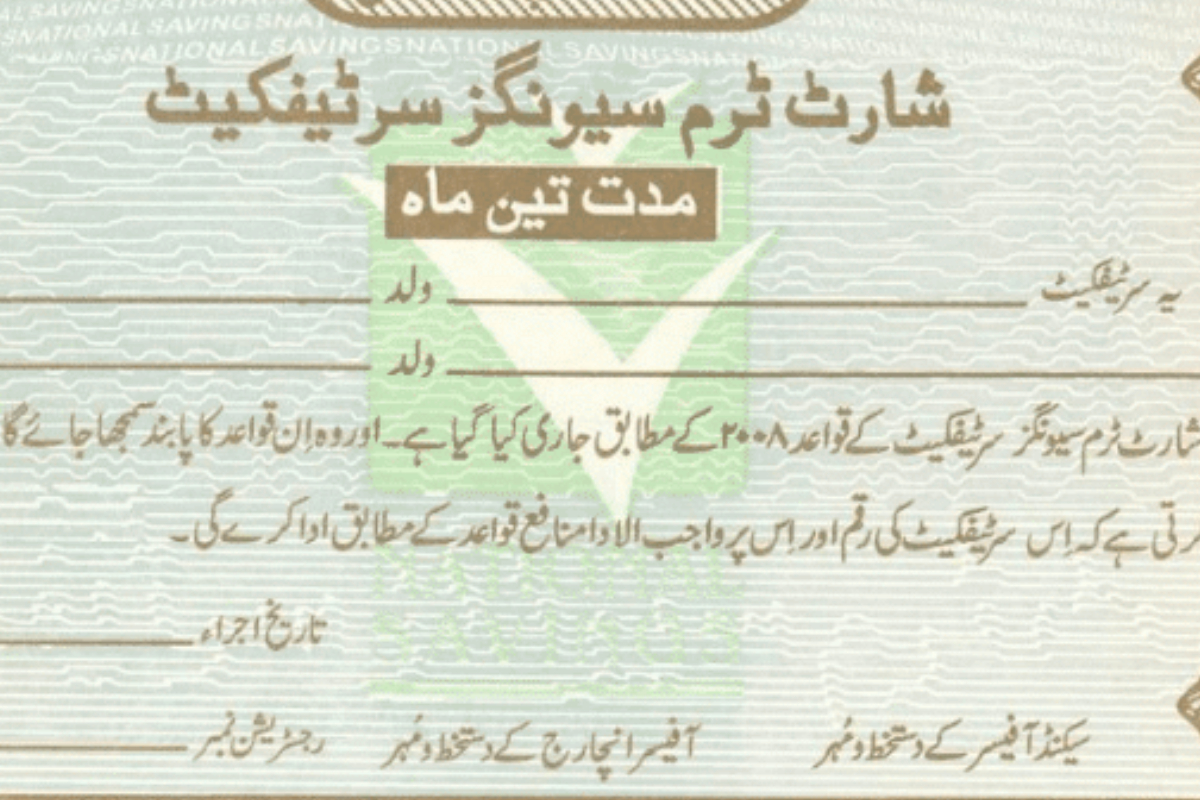

The Short-Term Savings Certificates (STSCs) program was introduced by the government in 2012 to meet the short-term funding needs of investors. The program offers maturity periods of 3 months, 6 months, and 1 year. Both Pakistani nationals and Overseas Pakistanis are eligible to invest in STSCs.

Investors can start with a minimum deposit of Rs 10,000, and there is no maximum limit on the investment amount. The certificates are also pledgeable, making them a versatile investment tool.

Latest Profit Rates (September 2024)

As of September 13, 2024, the Central Directorate of National Savings has revised the profit rates for STSCs:

- 3-month maturity: 18.52% (down from 19%)

- 6-month maturity: 18.22% (down from 18.92%)

- 1-year maturity: 17.22% (down from 17.9%)

Tax Deduction on Profit

- Filers: 15% withholding tax on profit.

- Non-filers: 30% withholding tax on profit.

STSCs remain a popular choice for those seeking short-term, flexible investment opportunities.

[embedpost slug=”/qaumi-bachat-bank-latest-profit-rate-on-special-savings-certificates-sept-2024/”]