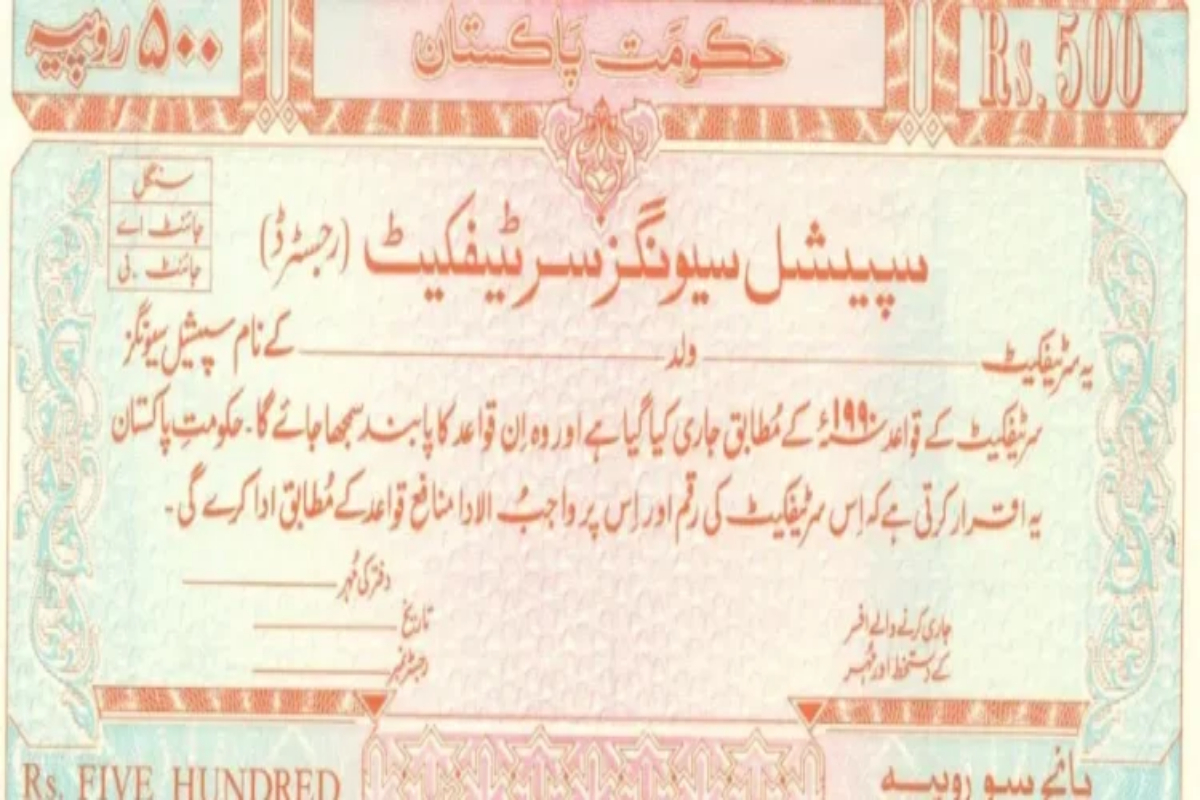

Special Savings Certificates, offered by National Savings (Qaumi Bachat Bank), are tailored for small to medium-range investors seeking bi-annual returns on their investments. Introduced to meet specific investor needs, this scheme offers a unique opportunity with a three-year tenure.

Revised Profit Rates Effective July 2024

In May 2024, the government revised profit rates for various products, including Special Savings Certificates. According to the new policy:

- Profit Rates: The profit rate is set at 15.7% per annum for the first five months and increases to 16.6% per annum for the sixth month.

Tax Deduction Guidelines

Taxation on Special Savings Certificates follows specific guidelines:

- For Filers: Individuals listed in the Active Taxpayer List (ATL) face a withholding tax rate of 15% of the yield or profit, regardless of the investment details.

- For Non-Filers: Those not listed in the ATL are subject to a higher withholding tax rate of 30% of the yield or profit, irrespective of the investment specifics.

These adjustments in profit rates and tax deductions aim to balance investor returns with tax compliance. The scheme continues to offer a reliable investment option with periodic returns, catering to diverse investor needs and preferences.

[embedpost slug=”/qaumi-bachat-bank-new-profit-rates-for-short-term-savings-certificates/”]