ISLAMABAD: The Federal Board of Revenue (FBR) has issued a notification of a scheme related to the compulsory registration of traders.

According to FBR, the registration scheme of retailers and wholesalers will initially be applied in six major cities, these cities include Karachi, Lahore, Islamabad, Rawalpindi, Quetta, and Peshawar.

FBR has also sought views from stakeholders on the scheme called Special Procedures for Small Traders and Shopkeepers.

According to the notification, the tax will be collected from the traders based on the annual rental value of the shop, every trader has to pay income tax of at least 1200 rupees annually, the traders who submit the income tax return for the year 2023 will also get a discount, the scheme is applicable. It will be from April 1, but the first tax collection will be from July 15.

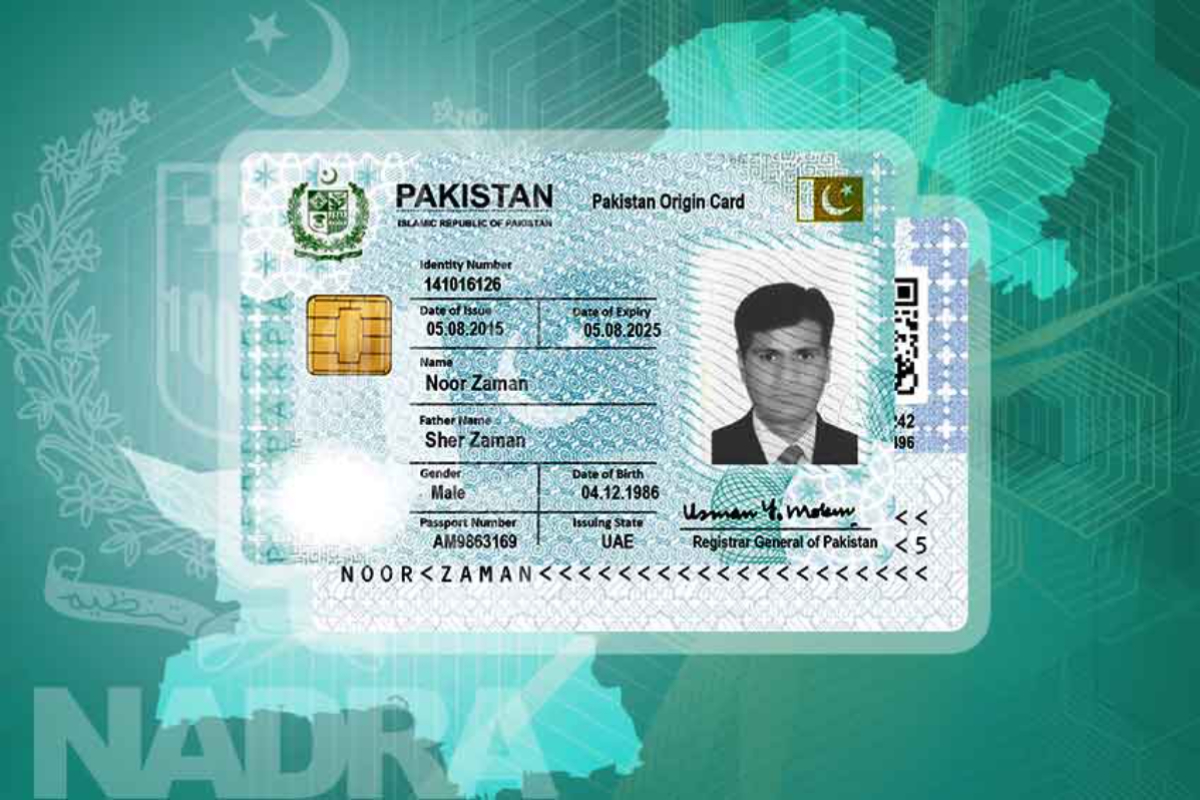

According to the notification, registration has been made mandatory for dealers, retailers, manufacturers and importers across the country, stores, shops, warehouses, and business offices will be required to register. The retailers and wholesalers will receive advance income tax by registering.

FBR said that in case of payment of tax before the 15th of every month, traders will get a 25% discount, in case of non-compliance with the law, they will be forcibly registered in the National Business Registry.

[embedpost slug=”fbr-decides-to-link-hospitals-gyms-colleges-with-software-system”]