- Millions of public sector workers angry that their pay is falling further behind inflation. Unions canvassing members, including teachers, nurses and civil servants about a walkout.

- Summer of discontent now appears set to last the rest of the year after series of strikes.

- Teacher unions are consulting with members about possible strike action. Civil service unions and the Royal College of Nursing are also on board.

The next prime minister of the United Kingdom will inherit the worst relations with unions and workers since the 1970s, with millions of public sector workers angry that their pay is falling further behind inflation.

Discontent among government employees is likely to be Boris Johnson’s most immediate legacy, regardless of whether Foreign Secretary Liz Truss or former Chancellor of the Exchequer Rishi Sunak wins the election in early September.

The pay settlements for 2.5 million British public sector workers announced last week sparked outrage. The government’s offer was almost always lower than the rate of inflation. Unions are now canvassing members, including teachers, nurses, and civil servants, about a walkout in protest this autumn.

This follows the devastating rail strikes that brought London to a halt in June. The summer of discontent, marked by waves of striking barristers and workers in formerly nationalised industries such as rail, mail, and telecommunications, now appears set to last the rest of the year.

Passengers at a nearly empty Newcastle station on Thursday morning, as train services remain disrupted as a result of the Rail, Maritime and Transport union’s nationwide strike. PA

There are even whispers among union officials of a “winter of discontent,” complete with Shakespearean overtones and memories of the rolling industrial action that brought down the Labour government and catapulted Margaret Thatcher’s Conservative Party to power in 1978 and 1979.

“I’ve never seen such rage,” said Kevin Rowan, head of organisation and services at the Trades Union Congress.

The most recent major public sector strike occurred in 2011 in response to pension reforms, when up to 2 million teachers, civil servants, National Health Service employees, and others went on strike for one day. “This is a bad time in terms of how people are feeling,” Mr Rowan said.

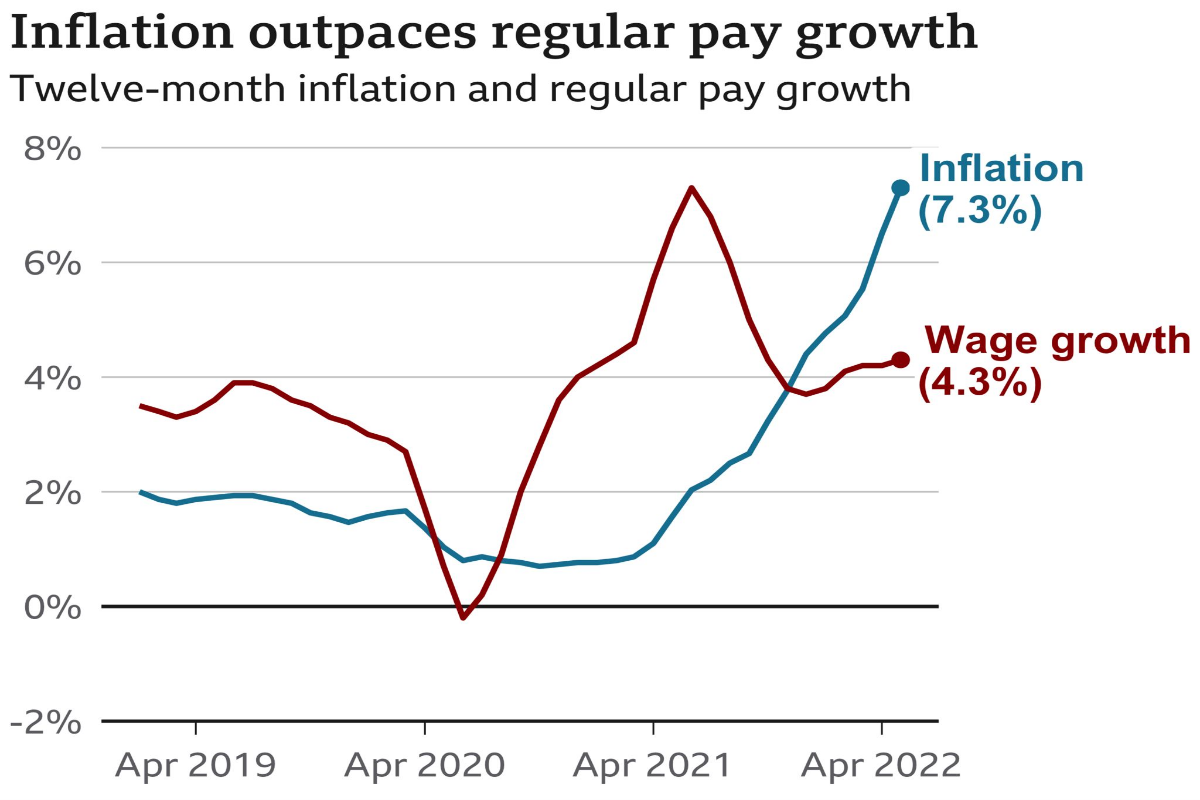

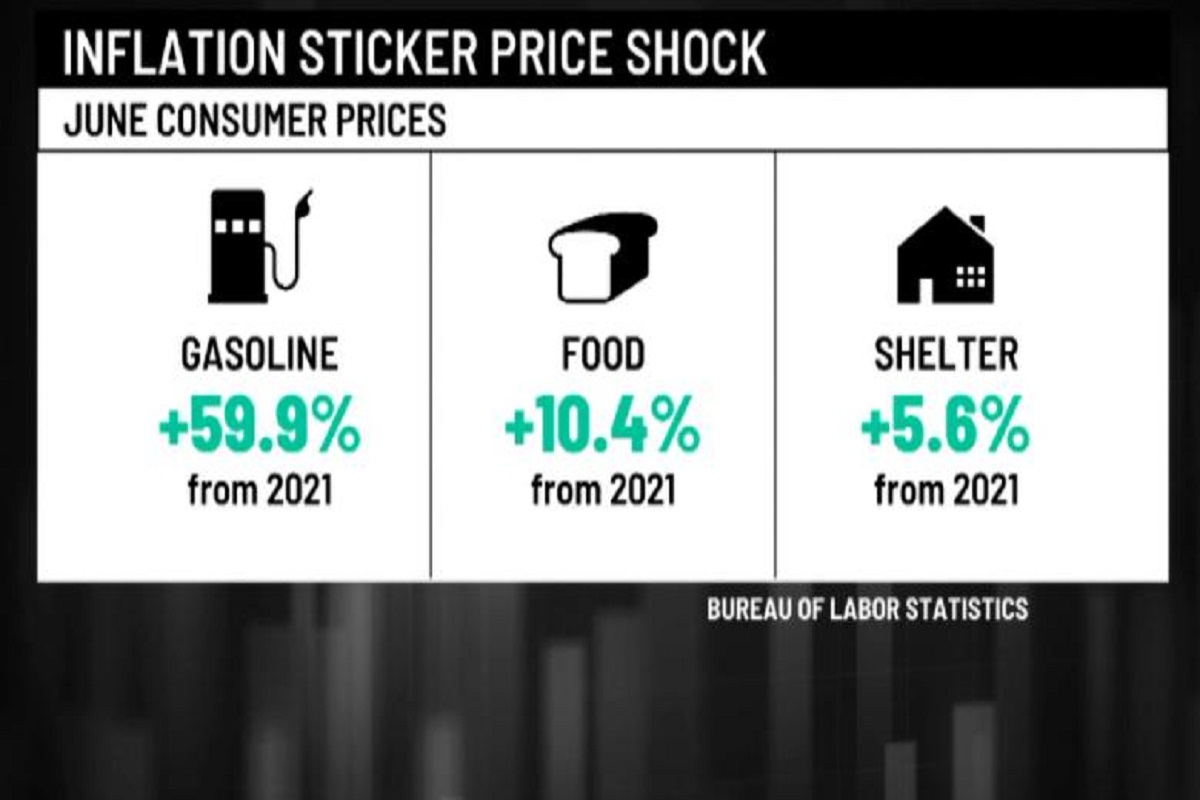

Wage growth across the economy is struggling to keep up with inflation, despite reaching a 40-year high of 9.4 percent. While some private-sector workers are receiving significant raises, particularly in hospitality and other trades where workers are in high demand, public-sector pay has lagged for more than a decade and is falling further behind.

STRIKES IN DETAIL

Which workers are set to strike this summer in the United Kingdom?

This has resulted in the greatest squeeze on consumer spending power in at least two decades, resulting in a cost-of-living crisis that research groups predict will result in more people falling into poverty. Traditional middle-class jobs are not immune.

Teacher unions, including principals, are consulting with members about possible strike action. Civil service unions and the Royal College of Nursing, whose General Secretary Pat Cullen welcomed “the growing public support, including over strike action,” are also on board.

According to Mr. Rowan, the number of consultations unions have with their members is extremely unusual. He anticipates that further ballots on whether to strike will be held in the coming weeks.

The UK public sector employs 5.5 million people (including local government and ancillary workers), accounting for approximately 15% of all workers in the economy.

Ballots and strike threats are frequently used to force employers to negotiate. For the time being, Ms Truss and Mr Sunak are both standing firm. They insist on the fairness of public sector contracts, with Ms Truss making a tough stance on trade unions a cornerstone of her bid to woo Tory members after reaching the final stage of the leadership election last week.

However, it may be difficult to maintain this stance in the face of growing public support for strike action. According to an Opinium poll, sympathy for strikers grew after 50,000 rail workers walked out in early June demanding better pay and terms.

“There has been a mood shift,” TUC general secretary Frances O’Grady told members of parliament last week. “We saw that with the public outpouring of support for some of the recent strikes.”

That support could be attributed to the elevated status of key workers in the national consciousness during the pandemic. Week after week, people across the country came out to “clap for carers” in hospitals and emergency services that cared for Covid-19 victims.

Nonetheless, the pressure on public sector workers is increasing, making them more important than ever. A total of 6.6 million patients are currently waiting for NHS treatment. There are also over 100,000 unfilled positions. According to the independent NHS Pay Review Body, anxiety, stress, and depression are on the rise, causing more problems with sickness rates and employee retention.

A similar story can be told about staff retention in education. Within five years, one-third of new teachers leave the profession. One way to boost morale is through pay.

“Pay isn’t everything, but it sure helps,” Ms O’Grady said.

Economic nonsense that keeps wages low

The trend towards weaker public sector pay has accelerated in the past five years, most starkly this year. The latest public sector settlements were for pay increases of about 5 per cent, which is below the 7.2 per cent private-sector average, according to the Office for National Statistics, and 4.4 per cent below inflation.

“To give you three examples, the TUC has calculated that since 2010 nurses are worse off in real terms by more than £5,000 ($6,013); porters by £2,500; and paramedics by £6,700,” said Ms O’Grady.

Aggravating the matter is the fact that government departments have been told to find savings of up to £2 billion to cover some of the pay rises. The next prime minister will be under pressure to borrow that additional money.

Then there is the argument that public sector pay restraint is needed to prevent a wage price spiral, but economists disagree. The Institute for Fiscal Studies said: “Fears of a ‘wage-price spiral’ in the public sector are overblown, given the fact that most public sector goods do not have market prices that can rise in response to higher wages.”

Health workers and teachers do not like striking, given the vital public service aspect of their roles, so it is possible that some of the disputes can be defused. But with anger rising, unwelcome echoes of the 1970s are growing louder, raising the risk of another era of industrial action and stagflation.

[embedpost slug=”/monkeypox-cases-around-the-world/”]

Read more