- Consumer prices increased 9.1% year over year in June, a record 40-year high.

- Fed Governor Christopher Waller: “I believe the markets would suffer a heart attack”.

- This puts pressure on central bankers to immediately stabilise the situation.

After a rocky start, central banks have demonstrated that they are committed to keeping inflation under control. Now that prices are rising even faster than anticipated, they are considering ever-more extreme solutions.

Investors are becoming more confident that the Federal Reserve will raise interest rates at its upcoming meeting for the first time in modern history by a full percentage point. For the first time since 1994, the Fed increased interest rates in June by three-quarters of a percentage point.

The news on Wednesday that consumer prices increased 9.1% year over year in June, a record 40-year high and a higher increase than anticipated, was mostly ignored by US markets. However, decision-makers expressed grave worry.

Raphael Bostic, president of the Atlanta Federal Reserve Bank, told reporters on Wednesday that “everything is up for grabs.”

Previously, Fed officials have voiced concerns about the effects of such a large increase.

Fed Governor Christopher Waller stated last month, “I believe the markets would suffer a heart attack.”

However, traders believe that such a remarkable surge is increasingly likely. According to CME Group data, markets gave it an 81 percent probability on Thursday.

Dissecting it: The inflation outlook is undoubtedly bad in the short term, which puts pressure on central bankers to immediately stabilise the situation.

President of the Federal Reserve Bank of San Francisco Mary Daly told the New York Times on Wednesday, “I saw the statistics and thought: This wasn’t good news,” though she added that she hadn’t been upbeat.

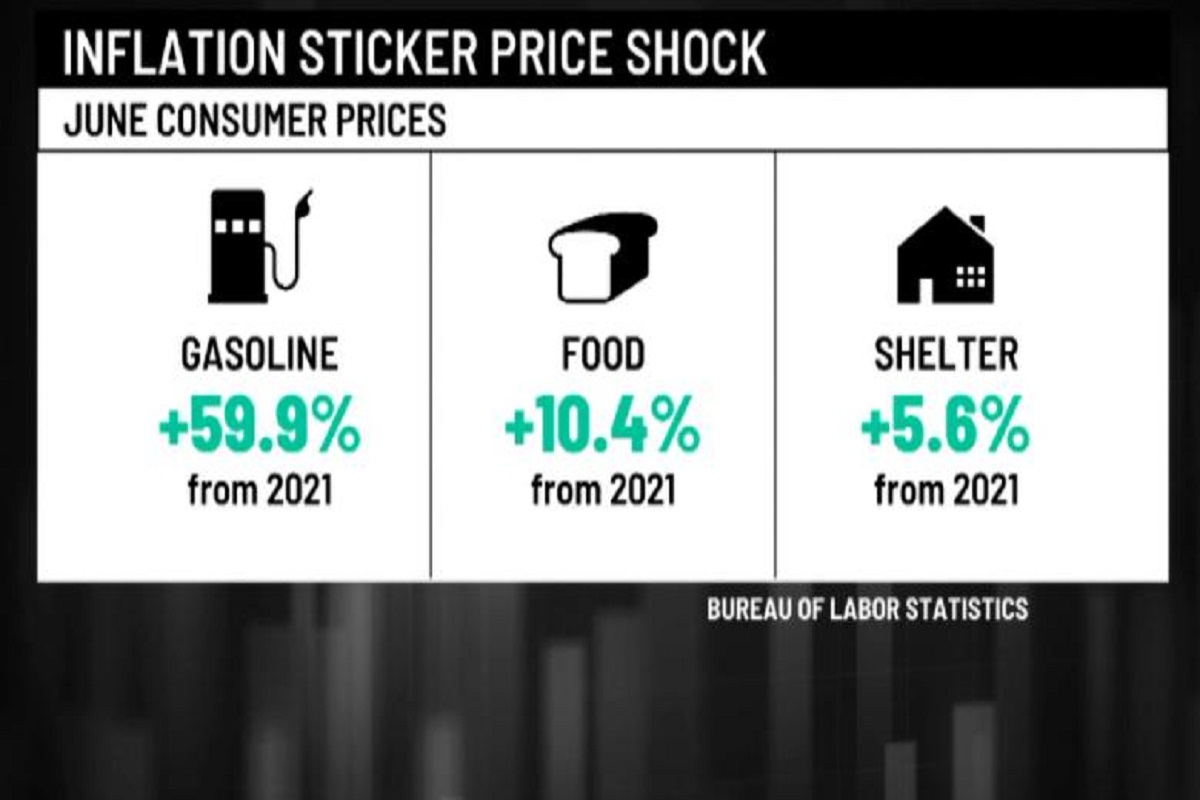

A significant portion of the June increase was caused by an increase in gasoline prices, which were up nearly 60% year over year. However, inflation worries now go beyond the energy sector. The shelter index increased 5.6% in the previous year (more on that below). While aeroplane rates increased by more than 34 percent during the same time period, the cost of home furnishings increased by 9.5 percent.

[embedpost slug=”us-home-prices-decline-as-interest-rates-rise-2/”]

Look to the country to the north of America for direction on what happens next. Inflation in the nation was “greater and more persistent” than the central bank anticipated in early spring, according to the Bank of Canada, which raised its main interest rate by one full percentage point on Wednesday.

There are other policymakers at work as well. Yesterday, rates in South Korea and New Zealand increased, while Singapore’s monetary authority and the Philippines’ central bank made impromptu moves to tighten policy earlier in the day on Thursday.

James Knightley, the chief international economist at ING, told me that it is obvious that other central banks are acknowledging the need to act. It now has “greater cover to proceed more aggressively” as a result.

Given worries among many Fed officials that raising rates this month may cause the US to enter a recession, Knightley is still forecasting a three-quarters increase. However, he pointed out that a full point rise is “definitely on the table” in light of the most recent round of inflation data.

Housing costs are significantly worsening inflation.

In yesterday’s Before the Bell, the more optimistic argument that inflation would decline in the medium term was emphasised. Today, after analysing the data from the Consumer Price Index, I wanted to go further into one of the greatest arguments against inflation: the price of housing.

In June, the housing component of the CPI registered its largest annual gain since February 1991.

Because housing costs are persistent and are rising, economists are concerned about this. Prices for both might fluctuate quickly. But when a person signs a lease, they are committed to paying rent for 12 to 24 months.

Observe this space In June, for the first time ever, the average monthly rent in Manhattan exceeded $5,000, according to a survey from the brokerage firm Douglas Elliman and Miller Samuel Real Estate Appraisers and Consultants. That’s an increase of about 30% from the previous year.

The US Bureau of Labor Statistics employs a basket of goods and services to measure consumer prices, and housing makes up about a third of the value of the basket.

Keep in mind that the Consumer Price Index can rise “for as long as 24 months into the future,” according to a February article from the Federal Reserve Bank of San Francisco.

Even though oil prices are falling and consumers have faith in the Fed’s capacity to function properly, this makes “peak inflation” hopes more difficult to realise.

Continued crypto bankruptcy cases

Many of the supporters of digital currencies I’ve recently spoken to have given the severe “crypto winter” that’s taken hold a good spin.

Their argument is that weaker or doubtful enterprises will fail as prices plummet and market unrest grows. Only strong companies will go to the next chapter and lay a more solid foundation.

Even if you agree with that argument, the interim time looks to be chaotic.

On Wednesday, Celsius became the most recent company in the sector to declare bankruptcy. Withdrawals and transfers were stopped by the 1.7 million user cryptocurrency lender last month due to “extreme market conditions.”

Voyager Digital, a different cryptocurrency lender, declared bankruptcy last week. It claimed that “deliberate and decisive action” was needed in response to the “prolonged volatility and contagion in the crypto markets over the past few months” as well as a customer defaulting on a loan.

Insight for investors: In the upcoming months, there will probably be more casualties. As fear continues to dominate investor sentiment, Bitcoin is lagging around $20,000, which is hurting investors who placed risky bets when values were considerably higher. The value of the digital coin has dropped by more than 70% from its high in November. Ether has fallen by over 78% from its peak.

[embedpost slug=”sri-lankas-central-bank-boosts-interest-rates-to-a-21-year-high/”]