- Emirates issues warning on Facebook about deceptive investment scheme using airline’s name.

- Fraudulent post claims new platform for investing in Emirates stocks with false promises.

- Scamadviser raises doubts about trademasterhub.com, recommending independent vetting.

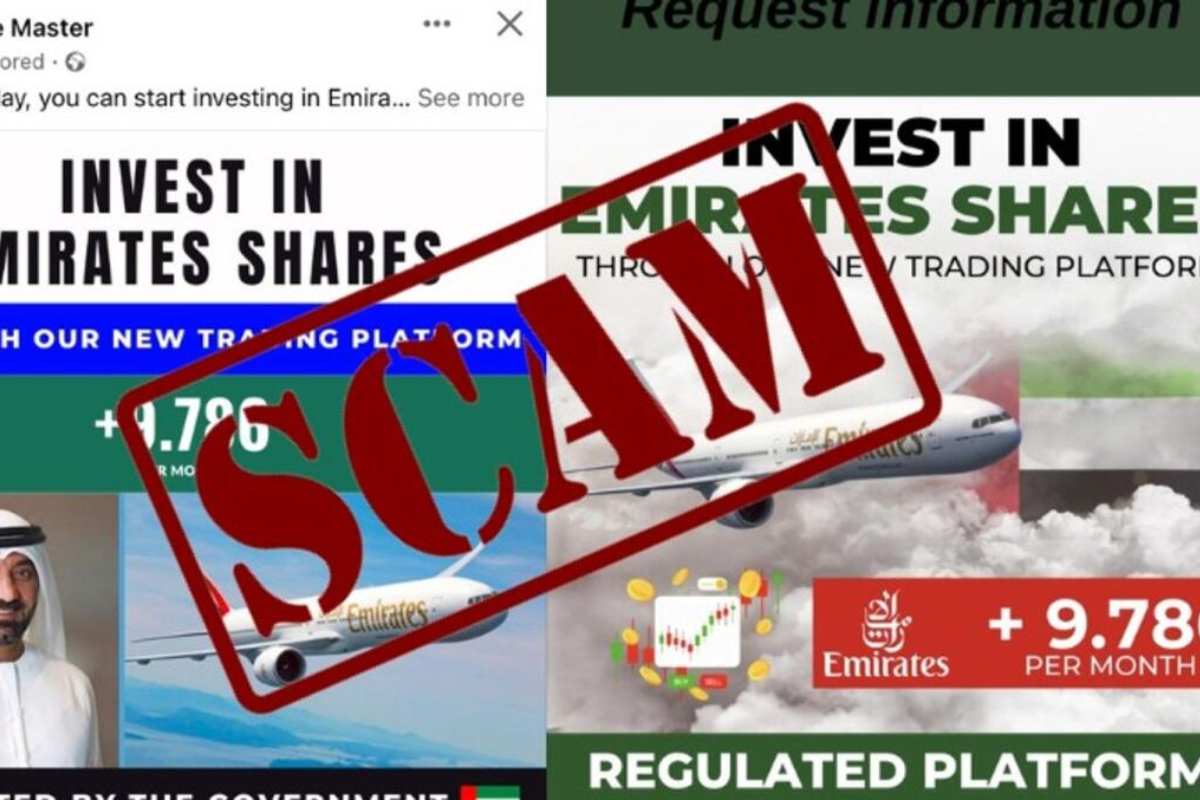

Emirates has issued a cautionary notice regarding a misleading investment scheme circulating on Facebook that exploits the airline’s brand. The deceptive post falsely announces the introduction of a new platform for investing in Emirates stocks, showcasing pictures of the CEO and an Emirates aircraft.

The deceptive scheme assures investors of nearly a 10 percent monthly return on a platform purportedly regulated by the government. The post entices with the claim, “You have a unique opportunity to generate $9700 a month by investing in Emirates shares starting at $200.”

A representative from Emirates, in a statement provided to Khaleej Times, warned about the fraudulent investment opportunities circulating on social media.

“We are aware of a social media page circulating regarding fraudulent investment opportunities in Emirates, and we advise caution,” the spokesperson said. “All Emirates announcements are hosted on our official channels,” the statement emphasized.

Throughout the week, the deceptive post has inundated the Facebook feeds of unsuspecting residents.

Individuals who respond to the deceptive post are redirected to the registration page of a website called trademasterhub.com. The accompanying message guarantees users, “We are here to assist you at every stage. To begin, kindly click on the link below that matches your preferred language. This will lead you to the registration page, where you can furnish your personal details and commence your investment journey.”

The registration form lures potential investors with a bold promise: “Would you like to turn $250 into $7,500? One of our investors will explain how.” Upon completing the form, participants receive a thank-you note along with a commitment of a call back within 24 hours.

In the course of the call, a consultant supposedly aids in the procedure of initiating and activating an account.

For those who disregard the call, a tantalizing message towards the end of the registration process teases, “Be ready to answer our call because there is a BONUS awaiting for you.”

What we found

Khaleej Times investigations unveil that the Trademasterhub website is merely a month old and lacks any details about its owners.

Scamadviser, an online service utilizing an automated algorithm to assess website legitimacy, casts doubts on trademasterhub.com.

In a detailed analysis, Scamadviser states: “The review of trademasterhub.com is somewhat low according to our computer algorithm. Scamadviser rates every website automatically by examining the server’s location, the use of an SSL certificate, ownership of the domain name, and other public and private sources. As said, the rating of the website is somewhat low. It is therefore recommended to do your own vetting to determine if the website is trustworthy or fake.”

The website of Trademasterhub has vanished, along with the Facebook page endorsing the scheme.

Recently, a troubling pattern has emerged, falsely linking several institutions and prominent individuals in the UAE and beyond to questionable online platforms.

In a recent incident, an Indian real estate agent in Dubai incurred a $100,000 loss on a deceitful trading platform, joining a growing roster of victims. Preceding this, R. Imran, a Pakistani banker in Sharjah, succumbed to the scam, suffering a loss of $21,000.

‘Malvertising’

Cybercriminals are increasingly blurring the boundaries between malvertising and deceptive advertising, employing manipulated images to create a facade of authenticity.

In 2021, a fraudulent get-rich-quick scheme falsely asserted that Bollywood superstar Shah Rukh Khan had invested Dh50 million in a Dubai-based fintech platform. The misinformation spread through a fabricated CNN article on social media, featuring counterfeit testimonials from purported UAE residents using stock photos to dupe unsuspecting individuals.

These scams often follow a familiar pattern. While browsing social media or a trusted website, you encounter a celebrity’s image with an enticing headline about substantial earnings from an investment scheme.

Clicking on it redirects you to a third-party page displaying the celebrity’s alleged profits. After providing your details, a fund manager contacts you, urging an initial investment. You receive a link and login details for the ‘trading platform,’ where your investments appear to grow. Encouraged, you invest more. Weeks later, your investment seems to multiply on the platform. Eager for returns, you contact the manager, who requests a commission deposit. Complying, you transfer the money, but the promised funds never materialize, and the expected call never arrives.

[embedpost slug= “bahraini-mp-refuses-to-sit-with-pro-israel-ambassadors-at-un-event/”]