- Inflation in the United States reached a new four-decade high in May.

- The US consumer price index (CPI) jumped 8.6 percent compared to May 2021.

- American drivers are facing daily record gas prices.

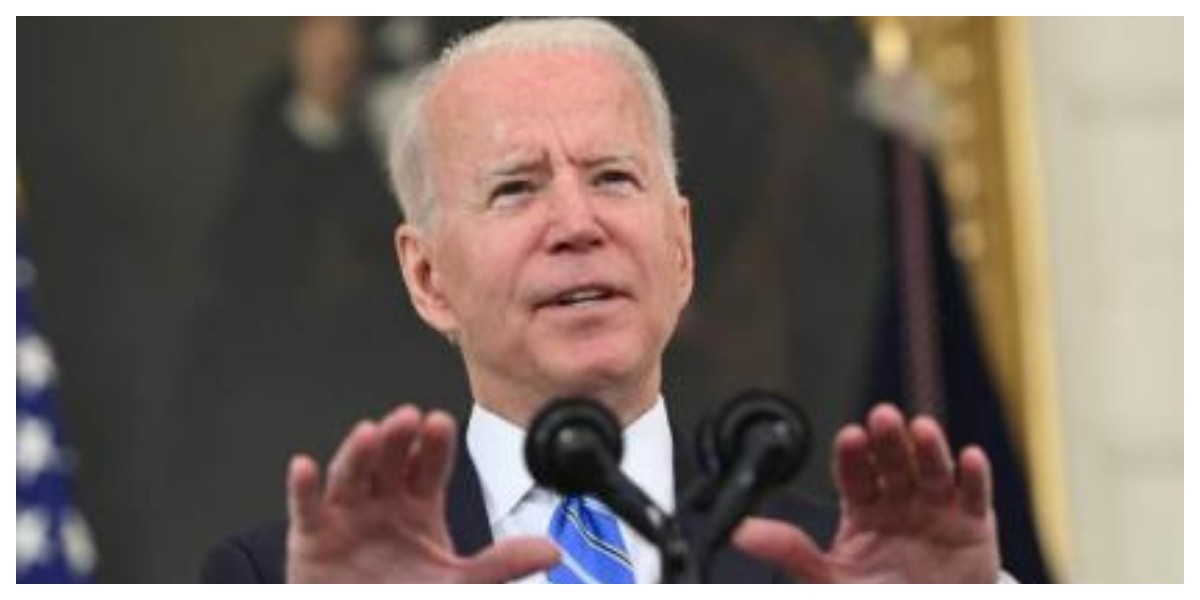

Inflation in the United States reached a new four-decade high in May, defying expectations that price pressures had peaked and deepening President Joe Biden’s political woes as Americans struggle to meet the ever-increasing cost of necessities such as food and gas.

Consumer prices in the world’s largest economy have risen at the fastest rate since 1981, with gas prices at the pump setting new highs on a daily basis as a result of Russia’s invasion of Ukraine and ongoing supply chain issues caused by the Covid-19 pandemic.

Biden, whose popularity has taken a hit as prices surge, has made fighting inflation his top domestic priority but is finding he has few tools to directly impact prices.

The president has tried to hammer home his optimistic message about the economic progress in the wake of the pandemic, including rapid GDP growth and record job creation while pressing Congress to take action to lower costs on specific products.

He is due to speak later Friday about the inflation challenge, and likely will renew his call to approve legislation to go after firms such as shipping companies that are taking advantage of limited competition to impose steep price hikes.

But the latest inflation data dealt a crushing blow to his efforts, as the consumer price index (CPI) jumped 8.6 percent compared to May 2021, up from 8.3 percent in the 12 months ending in April and topping what most economists thought was the peak of 8.5 percent in March.

Read more: Biden, Brazil president agreed to work on deforestation in Amazon

Prices continued to rise last month for a range of goods, including housing, groceries, airline fares and used and new vehicles, setting new records in multiple categories, according to the Labor Department report.

“The headline inflation numbers are dreadful. Strip away some special factors & they’re merely bad,” Harvard economist and former White House advisor Jason Furman said on Twitter.

Some economists expected the easing of pandemic restrictions to cause a shift of US consumer demand towards services and away from goods, which they said would ease inflation pressures, but prices for services increased as well.

And CPI rose one percent compared to April, after the modest 0.3 percent gain in the prior month, the Labor Department reported, far higher than expected by analysts who were looking for inflation pressures to ebb slightly.

Energy has soared 34.6 percent over the past year, the fastest since September 2005, while food jumped 10.1 percent — the first increase of more than 10 percent since March 1981, the report said.

Fuel oil, in particular, more than doubled, jumping 106.7 percent, the largest increase in the history of CPI, which dates to 1935, according to the report.

“The price of fuel oil and natural gas is working its way through the economy,” Biden economic advisor Brian Deese told CNBC. “The issue now is how can we actually make progress… that would improve that?”

“We’re calling on Congress to move on shipping legislation that would bring down the cost of moving goods overseas.”

Food and fuel prices have accelerated in recent weeks since the Russian invasion of Ukraine sent global oil and grain prices up, and American drivers are facing daily record gas prices, with the national average hitting $4.99 a gallon on Friday, according to AAA.

The United States has come roaring back from the economic damage inflicted by the Covid-19 pandemic, helped by bargain borrowing costs and massive government stimulus measures.

But with the pandemic still gripping other parts of the world, global supply chain snarls have caused demand to far outstrip resources. Meanwhile, the conflict in Ukraine has sent global oil prices above $100 a barrel.

The Federal Reserve has begun aggressively raising interest rates, with another significant increase expected next week and more in the coming months as policymakers attempt to combat inflationary pressures without triggering a recession.

According to Mickey Levy of Berenberg Capital Markets, the CPI surge “raises the probability of even more aggressive Fed rate hikes to tamp down on inflationary expectations,” and a pause in rate hikes in September is “looking increasingly unlikely.”

Read more: Biden announces a fresh Latin American economic agenda