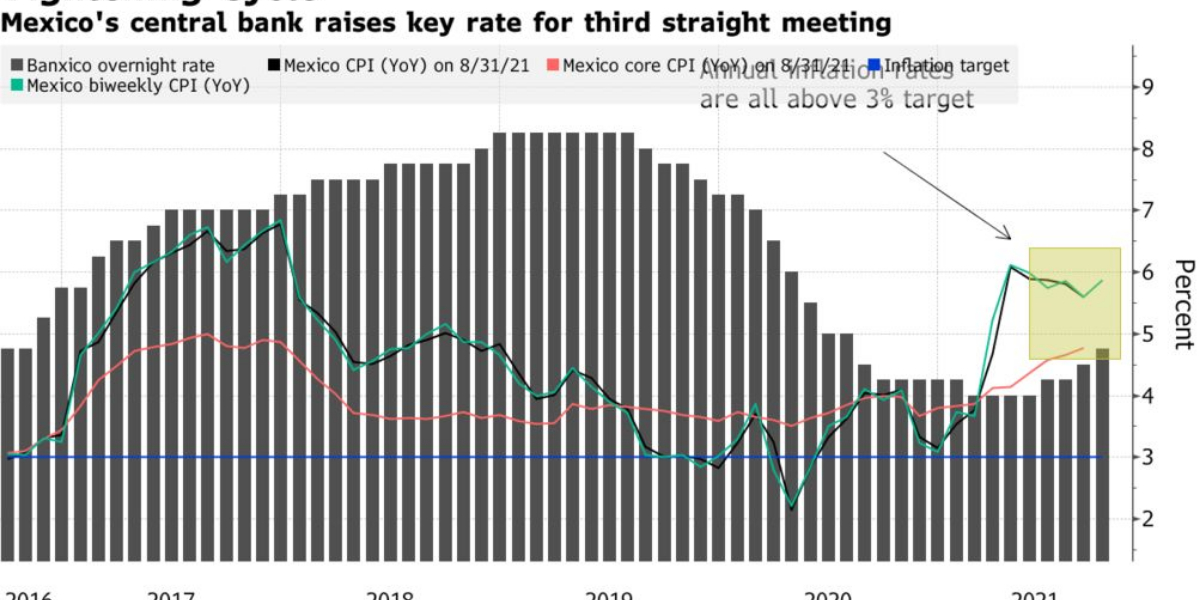

Mexico’s central bank raised its benchmark interest rate for the eighth time in a row on Thursday, attempting to temper inflation, which has reached its highest level in two decades.

According to the Bank of Mexico, the governing board opted to raise the interbank rate by half a percentage point, to 7.0 percent, with one member advocating a three-quarter percentage point boost.

The crisis in Ukraine and China’s coronavirus quarantines have pushed up consumer costs, affecting global supply chains, according to a central bank statement.

Mexico’s annual inflation rate hit 7.68 percent in April, the highest since January 2001 and much beyond the Bank of Mexico’s target of roughly 3.0 percent.

“With low growth in Mexico, one might think that it’s crazy that the Bank of Mexico raises its interest rate to 7.0 percent,” tweeted Gabriela Siller, head of economic analysis for the financial group BASE.

“However, for Mexico, a high level of inflation slows down the economy more than a high-interest rate,” she added.

Without the monetary tightening, inflation would most likely be 10% or higher, according to Siller.

The Bank of Mexico warned that the price outlook has deteriorated further.

Rising agricultural and energy prices, as well as the coronavirus pandemic and a weaker peso against the dollar, might all contribute to higher inflation.

It could, however, ease in the future if the war ends and global supply systems improve, according to the report.

The Bank of Mexico reduced its economic outlook in March, anticipating growth of 2.4 percent this year, as concerns about inflation and weaker US growth grew.

According to a preliminary government estimate, Mexico’s economy, the second-largest in Latin America, increased by 1.6 percent in the first quarter of 2022, extending a rebound from profound pandemic-induced depression.